People that start new Amazon businesses sometimes say things like: “I don’t want to screw myself down the line. Am I required to pay income taxes the second I make any money using Amazon FBA?”.

The short answer is yes. You need to report your Amazon sales as income on your taxes, just like your other income streams.

That’s why tax season is not when you need to get everything together for your Amazon FBA business. If you let it build up, you’ll only make more work for yourself and possibly miss things when you do report.

Here’s What We’re Covering:

- What Is The Amazon 1099-K Tax Form

- Who Qualifies for an Amazon 1099-K Tax Form?

- What Qualifies as Income

- Reporting Income Selling Outside the US

- Understanding Sales Tax Nexus

- Use Receipts to Track Amazon Tax Deductions

- Wrapping This Up…

What Is The Amazon 1099-K Tax Form

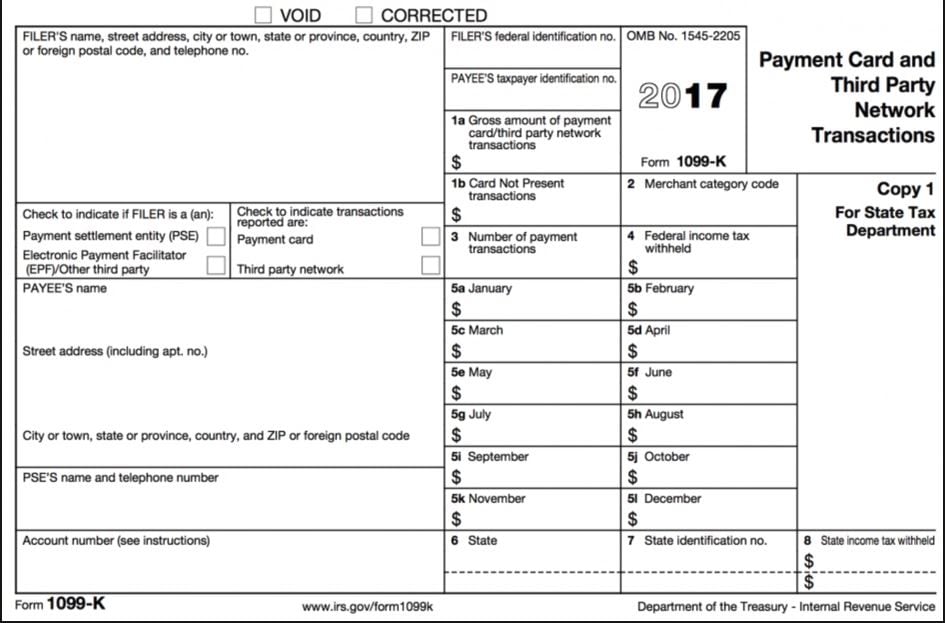

The 1099-K Tax form is how the IRS knows your monthly and annual gross sales information. Amazon uses it to report sales information, sales tax, and shipping fees. However if you’re an individual Amazon seller then you’re not responsible for filling out an Amazon 1099-K because an individual seller would most likely not meet the income threshold.

Do You Have to Report Amazon Sales on Your Taxes?

There often seems to be a lot of confusion about Amazon FBA taxes that stems from the “$20k rule.” This rule means that all sellers who use marketplaces such as Amazon and make more than $20k of unadjusted gross sales or have more than 200 transactions must report Amazon sales on their taxes. Amazon will automatically have a 1099-K form filed out for you by their payment provider.

In short, yes, you need to report your take home income on Amazon when you file taxes. And if you meet the $20k/200 transaction criteria the IRS already knows your Amazon business exists so you can’t forget to file.

Not meeting the criteria above doesn’t mean you don’t have to report your Amazon FBA income tax. If you’re a professional seller or you’re an individual seller with over 50 transactions then you need to make sure your tax information is up to date with Amazon. If your tax information is not up to date then you can lose your Amazon seller status.

What Qualifies as Income

The IRS wants to know your Amazon gross annual income, which includes everything that came in, not just the cost of the product for the customer. This means that gross income numbers include shipping charges.

One thing we will always recommend, particularly if you’re not sure is to consult with a qualified accountant. Under-reporting your income on Amazon is a risk that you run which might catch up with you unpleasantly later on if the IRS decides to audit you.

This means, as a general rule, just report every dollar that came into your business.

We highly recommend using automated accounting solutions such as A2X with Xero to make life easier. This way, your Amazon income reporting can be automatically pulled and there will be little left for you to sort out manually.

Reporting Income Selling Outside the US

If you are selling on Amazon outside of the US you are not liable for US tax. IRS regulations require non-U.S. taxpayers to provide Form W-8BEN to Amazon in order to be exempt from U.S. tax reporting requirements.

(Check out Amazon’s information on third-party reporting to the IRS here).

US-based Amazon sellers will need to file taxes, even if below the threshold for an instant Amazon 1099-K.

Where on Seller Central is the 1099-K

If you think you should have received a form 1099-K but didn’t, you can access the form from your Seller Central Account:

- Go to Sellercentral.amazon.com

- Go to the “Reports” Section

- Select “Tax Document Library”

- Select Applicable “Form 1099-K”

Check for errors on the 1099-K

It’s important to check your form and look for errors on the 1099-K before reporting to the IRS. Amazon isn’t perfect and they can mess up your sales data. You want to look at the box 1a on the 1099-K. This number is likely and estimate for the total sales for the past year.

You want to run another report that will allow you to see the numbers that make up the Amazon 1099-K amounts.

- Go to Sellercentral.amazon.com

- Go to the “Reports” Section

- Select “Date Range Reports”

- Select Generate a report

- Tap the following settings: Summary, Custom, and enter the date range for the applicable tax year.

- Hit the Generate button

- Next, download the repot

The 6 numbers that you need to add up to make sure they match your Amazon 1099-K are as follows:

- Product sales (non-FBA)

- FBA product sales

- Shipping credits

- Gift wrap credits

- Promotional rebate refunds (Note: This will be a subtraction)

- Sales, shipping, and gift wrap tax collected

Adding up these 6 numbers should match exactly to box 1a of your Amazon 1099-K. Also something else to think about is your legal business entity for your Amazon business to try and lower your tax burden. It’s possible that certain business types can benefit you more as an Amazon seller than another.

Understanding Sales Tax Nexus

Amazon FBA sellers are liable for collecting sales tax in all states where they have “nexus”. Nexus is defined as a physical business presence in a given state, meaning where Amazon warehouses store your physical products.

Stop stressing about sales tax and get on with your FBA business

Now:

You have nexus in any state that stores or ships your products from an Amazon Fulfillment Center (Amazon has fulfillment centers in 20+ states). Also, you have nexus in your own home state, particularly if you maintain any kind of office or business-related facility there.

And, you potentially have nexus in multiple states, so you will need to determine filing requirements (or use a service such as TaxJar which will auto file for you).

Deductions

Expenses add up as an Amazon seller so use them as deductions of your overall gross Amazon income.

Again, these vary in their application so check in with a qualified professional to make sure you’ve got it right.

Honestly, there are so many variations in the tax code that you may well be short-changing yourself if you try to do it on your own without knowing your full entitlements.

Common deductions might include:

- FBA Inventory costs (use an Amazon inventory management tool to help with this).

- Amazon Fees

- Amazon Software and FBA subscription fees.

- Supplier Shipping and office supplies.

- FBA Seller Education or FBA business-related courses.

- Donations of items.

- Home office deduction (you may have a deductible percentage of your rent or mortgage).

- Mileage

- Health insurance plans (talk it over with an accountant — this applies to specific types of plans).

- Retirement plans (as above).

- FBA Sourcing Travel and meals where business-related.

Of course, you need to keep track of all of these expenses throughout the year, or face a possible scramble trying to figure them out prior to filing taxes for your FBA business.

The key is to have receipts for everything — the tax code changes fairly regularly with new deductions permitted or some you were once allowed being removed.

If it’s a business-related cost, file a receipt.

Use Receipts to Track Amazon Tax Deductions

As an Amazon FBA seller, you probably get many of your receipts for tax-deductible expenses sent via email.

Most automated accounting programs allow you to forward the email to them for automatic storage of your receipt. (including Xero or Quickbooks)

If you’re not using a program with this capability, there are other receipt apps available via which you can forward email receipts, such as Shoeboxed.

You can scan physical receipts into it for storage and track any mileage with it.

It helps you to create expense reports and even stores business card information if you need it as well.

Many FBA business owners short-change themselves come tax season on potential deductions because they don’t have their receipts well-organized.

Use a receipt app if you’re stuffing tax-deductible receipts into a shoebox or searching through purses, wallets, and desk drawers.

Wrapping This Up…

If you’re a DIYer, you might choose to use a program like Turbo Tax and input everything yourself, which means you’ll need to have all summary figures of income and tax-deductible expenses available.

Therefore, Keep all receipts and summary statements in a specific “taxes” folder marked for the particular year you are filing for.

When visiting your accountant to have your Amazon FBA taxes done, here’s what they like to see:

- Financial statements. These might include a balance sheet, income statement and cash flow statement, although the one most important to your accountant for tax filing is the income statement.

- Summary of business expenses, including cost of goods sold and any inventory write-offs or donations.

- Vehicle log is applicable for business-related use.

- Home office expenses.

- Form 1098, showing mortgage interest and property taxes. This is for the home office deduction if you have a mortgage.

Additional Resources:

If I reside in the US and sell on amazon US but am a Canadian citizen, to which country do I pay income tax & will amazon report my income to the Canadian gvt?

How do i need to setup with tax details i am totally new in this system

Where are you located Ravi?

Tax time is a pain but this article will help people most people who don’t want to hire an accountant. It just makes sense to me to hire a professional who can make the adjustments and knows all exemptions/deductions by heart. If you can spare some $ you need to hand this off to a pro.

You’re absolutely right Jae, thanks for the insight 🙂 It completely depends on the person and what they’re comfortable with doing.

I’ve made over $100k in sales for the first time through Amazon FBA. When I did taxes this year with the 1099 Amazon sent me, I end up owing $18k in taxes after all of the smoke cleared. I placed every single deduction possible and ran it over three or four times. I even had a TurboTax CPA look over it and I figure is right. What is possibly wrong here? The only other possible reason why I’m still owing is that Amazon doesn’t withhold taxes. I’m looking into this but maybe you would know.

I did a search online but no one else has the same problem I do which is hard to believe. Anyway, any help with will be great. Thanks!

Hank, Amazon does not withhold taxes for you because you are not their employee. You’re essentially a contractor using Amazon as a platform to make sales online. Remember you don’t pay taxes on revenue you only pay taxes on profit (the amount of money you keep). So when you file your taxes and say you made 100K but you only took home $30,000 because you invested back into your business then you only owe an income tax on the $30,000.

Now if you kept 100K in profit then $18,000 is actually lower than the 23% effective tax rate for someone making 100K per year. Someone making 100k should be paying $23,000 in taxes with no deductions.

So again, your question depends on the amount of money that you kept, not the amount of money that you earned.

I live in India. I am interested in doing dropship model retail business, selling products in Amazon and eBay, in the USA. I wish to open a website as well. This will also be on dropship model. As an Indian, can I do dropshipping business in the USA, using the dropshipper in the USA. Would you suggest anyone helping me to do this. Look forward to your suggestion.

You can absolutely start that business from India. Even if you work with a US company to fulfill your products since you are not a US citizen and do not live in the US then you are not subject to US income tax. What exactly do you need help with so I can give you more details

Will – Thanks for your immediate response. I wish to have a reliable service provider who can help me with registering an LLC, Opening Bank Account, Getting EIN Number for the Co., Sales Tax Registration, Filing Sales Tax Returns, Getting Exemption for US Income Tax, etc. In short, I want to have someone who can help me with completing all the formalities to start and run my business. I will take care of selling the products in the USA market. This is my requirement.

If you are looking for a service provider and don’t want to do anything yourself then I recommend hiring a tax professional. They can help you with all of that. But you want to make sure that you find a tax professional that specializes in online businesses.

looking at your post here, if i am living out of USA and not being a US citizen, yet holding a company in NEW YORK, would i be able to place items in amazon FBA but still keep paying income tax in my country?

Hey Omri, being that you’re living in New York things might work a little bit differently but not because of income taxes but because you might be storing products in the state of New York. The general rule is that if of you’re not a US citizen then you do not pay US/NY income taxes. You’re subject to income taxes for your home country. But since you live in NY what I would recommend to do is reach out to a certified accountant that focuses on online businesses. But if you are struggling with other Amazon business related questions please feel free to email me will@startupbros(dot)com

hello! just want to ask, what if you are dual citizen with the US and the philippines? but i’m based in the philippines. Am I required to pay taxes in the US?

Hey Paul thanks for reaching out. If you are making an income anywhere in the world and you are a US citizen then you are subject to federal income tax in the United States. But to get a more in depth answer I would talk to a CPA in the United States to make sure that you are doing everything the right way.

I am an Indian. I wish to resell products in the USA. For this, I wish to use the dropshipper in the USA to sell the products in the USA (through amazon) itself. Can I do that. Still whether I will be exempt from paying Income Tax in the USA. Look your confirmation.

Hey Karthik if you are living outside the US and not a US citizen then you are not subject to income tax in the US. It doesn’t matter if you sell products in the United States.

Will – Thanks a lot for explaining everything.

Hey Karthik, thanks for checking out the article! I’m glad you found it useful 🙂

Quite Informative. Clarified doubts on Non-US guys Income Tax liability.

Awesome! Thanks for reading 🙂

Hi, this is very informative article thank you. So as FBA international seller i don’t pay ANY income tax for the US government regardless how much is my income?

Correct, you just need to apply for the exemption.

Great article, much thanks to Startupbros! I have a question.

Is there anybody living in China? If yes, do you use your PAYPAL in China, are you able to transfer and withdraw money from your Paypal account? Do you pay taxes for selling good in America from China?

If you’re a US citizen it doesn’t matter where you live. You’re liable for taxes anywhere in the world. Yes your Amazon income that’s held in PayPal needs to be reported to the IRS. Not sure what you mean by withraw money from Paypal account. What are you withdrawing it for, to pay the factory or shipper, or something else?

Kent you’re absolutely right. If you’re a US citizen no matter where you live you’re responsible for income tax. But if you’re not a US citizen then income tax isn’t applicable. At the end of the year PayPal can send you a form that says how many transactions you had on your account so you can file your taxes. You can withdraw your money for any reason but it’s important to separate business expenses and personal use.

That is a really good tip particularly to those fresh to the blogosphere.

Simple but very accurate info… Thank you for sharing this one.

A must read article!

Very helpful article and I agree with the opinions.

Thanks for reading the article Andy 🙂

Just great information. I and my cousin are selling over $100K on Amazon after 3 ms, the Delaware LLC owned by my German cousin and using my address in the USA to set up the US Amazon account, shipping direct from overseas. I do all the customer relations, returns etc. which keeps me busy.

How should we set this up for taxes?

He owns everything and it is his LLC.

I will share profits (we are close and have not decided a number or % yet). Should I take a salary for my work, a single profit sharing payment at the end of the year? What is the easiest way to set this up tax-wise for both of us as he lives in Germany?

Best, Mark

Hey Mark, the first thing I would do is talk to a CPA. Because the amount of sales your doing is enough to warrant an audit if you report income incorrectly. With that being said, you only pay taxes on the income that you keep. So yes, paying yourself a standard salary and then a single profit share “bonus” at the end of the year is the cleanest way to do it.

Again, your situation is unique and I would you need specific advice to your situation. I created an Amazon mastermind with sellers all over the world making over $1MM per year. Send us an email and we can talk more in-depth better than we can in the comment section. Go to http://thehivemind.co and on the bottom right corner of the screen you can send us an email. Hope to hear from you soon!