The short answer is no. You don’t need a business license or sales tax permit to open a seller account and start selling products online.

The long answer is, it’s complicated…

Table of Contents

DISCLAIMER: Don’t take my advice. I dropped out of high school. Talk to a lawyer to confirm what I say.

When You DO NOT Need a Business License or Sales Tax Permit:

For most people reading this, you will NOT need to register for a business license or seller’s permit before you start your online business.

That’s because all e-commerce platforms allow your to create a seller account as an ‘unincorporated entity’ such as a ‘sole proprietorship’ or ‘general partnership’.

Unincorporated Entity = Fancy way to explain someone who started doing business without officially creating a business entity like an LLC or Corporation.

Sole Proprietorship = An ‘unincorporated entity’ with one owner

General Partnership = An ‘unincorporated entity’ with multiple owners

So yes, you can start selling products on any of the following marketplaces without forming a business or registering for any business license or seller’s permit:

- Amazon

- Etsy

- Shopify

- eBay

- Walmart

- Facebook Marketplace

- Craigslist

- TikTok Shop

I’d venture to say that over 80% of successful e-commerce sellers get started as an unincorporated entity…

There’s no point in paying the fees to file for an LLC and pay for the permits you’ll need long-term up front. Wait until your idea is actually making money, then set up the optimal structure.

This is the optimal route for almost everybody getting started as an e-commerce seller. Validate your business idea, then get the right legal entity set up around it immediately once it starts working.

But being an unincorporated entity does have some major downsides, which I’ll talk about more below…

First, let’s cover the exceptions…

When You DO Need a Business License or Sales Tax Permit:

To answer this, you have to know the difference between a business license vs a sales tax permit (also known as a seller’s permit)…

What’s a Business License?

Business License = A general license that grants your the legal right to operate a business within a certain jurisdiction (city, county, state, or federal).

If you live in the United States, it’s extremely rare to require any type of business license when getting started…

You probably don’t need one, and won’t ever need one…

But to make sure, all you need to do is think about all the different legal jurisdictions you’re in – Federal > State > County > City

Federal:

There’s a small list of Federally Regulated Products that do require a business license to operate. Check to make sure your product doesn’t fall into those categories. But the only one I’ve ever seen people run into is Food & Beverages, which only becomes federally regulated once it crosses state lines.

State:

To my knowledge, there is no State that requires a general business operating license when you’re first getting started. State business licenses are usually aimed at regulating specialized professions (like doctors & lawyers) or niche industries (like farming or mining).

County:

If you live in a State that is generally unfriendly towards small businesses (like California or New York), this is where you’ll usually start to find the hoops you need to jump through…

For instance, California specifically does not have a general business license that’s required to start/operate a new business. They intentionally leave it up to local jurisdictions (counties & cities) to set their own rules.

City:

Unfortunately you must comply with all business license rules all that apply to where you/your business live. So if you live in a business-unfriendly city in a business-unfriendly county in a business-unfriendly State…you might need a lot of licenses! California even created a tool called CalGold, so you can see all the different permits & licenses you need depending on where you live.

NOTE: Even if you technically require a business license from your city/county/State, 3rd party marketplaces like Amazon will still let you open a seller account & start selling products.

Business licensing issues are between you & whoever is requiring them, and there may be penalties for failing to comply.

However, there are many sellers who start their business completely oblivious to any licensing issues. And most jurisdictions are rumored to give some leniency to new business owners in failing to comply with local licensing requirements.

So in conclusion, very few people outside of highly-populated areas of California & New York will need to think about business licenses at all when they’re first getting started. But everybody should check what’s required in all the jurisdictions that apply to them once they’re up & running.

It’s quick & easy to check which local business licenses you might need. Just Google these things and do a bit of research –

business license requirements state

business license requirements county

business license requirements city

What’s a Sales Tax Permit?

Sales Tax Permit = State-issued seller’s permit, which allows you to collect sales taxes on behalf of the State (which you’re then required to pay to the State). Also allows you to NOT pay sales taxes when purchasing inventory.

NOTE: All 3rd-party marketplaces (Amazon, Etsy, eBay, Walmart) now act as ‘marketplace facilitators’, which means they collect & remit all necessary sales taxes on your behalf. So if you’re only selling on 3rd-party marketplaces, you don’t need to worry about this (especially when you’re just getting started).

Different States have different names for sales tax permits, but they are all effectively the same thing…

- Sales & Use Tax Permit (Florida, Texas, California)

- Certificate of Authority (New York)

- Vendor’s License (Ohio)

- Reseller Permit (Washington)

All of these are you registering your business with the State, and saying “I promise to charge sales taxes when I sell my products, and I promise to pay those sales taxes to you”.

It also allows you to not pay sales taxes when purchasing any inventory (products you resell), whether that’s from a wholesale supplier, manufacturer, or even most major retailers like Walmart or Costco.

All States that have a sales tax will (eventually) require you to register within that State for a sales tax permit. But the thresholds where this becomes a requirement vary quite a bit (you can check them here).

In general, you want to wait as long as you possibly can before registering for ANY sales tax license. Once you open a sales tax account with the State, you are usually required to file quarterly & annual reports (even if you’re not making any sales).

So which States do you need a sales tax permit from, and more importantly when?

That all depends on when you establish ‘nexus’ with each State…

Nexus = Fancy way to say your business is now required to register for a sales tax permit in a certain State

The way you establish nexus is either through physical presence (where your business physically lives) or economic activity (sales).

NOTE: There is also something called ‘marketplace nexus’, which is what requires 3rd-party marketplaces to act as ‘marketplace facilitators’ and handle sales taxes on your behalf.

That drastically simplifies things for new sellers. So unless you’re launching your own e-commerce store (with something like Shopify), you can likely get started without worrying about sales tax permits at all).

Economic nexus is established once you sell a certain number of units (usually 200) and/or reach a certain amount of sales (usually $100,000) within each State. Some States have different threshold (check them out here), and they apply to every business (whether you have a physical presence or not).

This means that you probably don’t need to worry about economic nexus until your business is up, running & selling a significant amount of products…

But physical presence nexus is something you need to know about from your very first sale…

You’ll always have physical presence nexus wherever your business (or you) are physically located. This includes physical locations where business is done, along with warehouses in which you store inventory (among other things).

This is especially important for Amazon sellers using FBA warehouses, as your inventory is often split between FBA warehouses in several different States – creating a physical nexus nightmare…

Luckily, the latest ‘marketplace facilitator’ requirements makes this a non-issue for sellers who operate exclusively on 3rd-party platforms like Amazon, eBay, Etsy, etc.

But if you’re selling on both 3rd-party marketplaces AND your own store, things can quickly get complicated. If that’s you, dive deeper into sales tax setup for your e-commerce store here.

But for most people reading this, you’re just a new seller trying to get started on a 3rd-party marketplace like Amazon or Etsy…

And in that case, you shouldn’t need a sales tax permit to get started – as ‘marketplace facilitator’ laws require 3rd-party marketplaces to collect & remit sales tax on your behalf…

When You WANT a Business License or Sales Tax Permit:

So you can open a new seller account and start selling products online without any of the following:

- You don’t need to incorporate: You can start an ‘unincorporated entity’ like a sole proprietorship, and use you Social Security Number (or equivalent) as your Tax ID.

- You (probably) don’t need a business license: Outside of a few extreme jurisdictions, nobody needs to give you a ‘license to sell’. This is America. Go sell.

- You (probably) don’t need a sales tax permit: Unless you’re launching your own e-commerce store, since 3rd-party marketplaces now handle this for you.

3rd-party marketplaces simply don’t care. They need a Tax ID to report your earnings to the IRS & local tax authorities, and that’s all they really care about…

So if you’re a new entrepreneur, you can probably just get started and focus on selling before you worry about creating the optimal legal entity around it…

Experienced entrepreneurs know, you’ll end up killing off well over 50% of the business ideas you try. So by worrying about this stuff before you actually start making sales, you only end up drowning yourself in expensive fees & useless paperwork.

That being said, you don’t want to operate like this forever. The fees & paperwork quickly become worth the advantages once your company is up & running…

When You WANT to Incorporate

Incorporating means setting up a legal entity for your business (like an LLC or Corporation).

For most people reading, you would likely be setting up an LLC (limited liability company), which you will then elect to be taxed as an S-Corp.

Incorporating as an LLC (and filing S-Corp tax election) actually has nothing to do with business licenses & sales tax permits. But it offers a few main benefits:

- Liability Protection: Creates legal separation between you & your business, which means your personal assets (home, car, personal bank accounts) are protected from being used to satisfy business liabilities.

- Tax Benefits: Allows you to split your income between employee salary & owner dividends, which means less earned income taxes owed. Last I checked, this becomes significant at just over $100k of annual business income.

This is an oversimplified explanation, and there are situations where a traditional C-Corporation makes more sense. But most new entrepreneurs are best served with an LLC taxed as an S-Corp.

Whenever you register a new corporation, you’re creating fees & paperwork for yourself (both now & in the future). Even if your Amazon business or Etsy shop doesn’t take off, you’ll still be obligated to keep paying fees & filing paperwork.

So in general, it’s best to validate your business idea before creating a legal entity around it. Especially if you already have an existing LLC or Corporation, since you can launch your new business from ‘within’ your existing entity.

For instance, I launch almost all new startups from the StartupBros LLC. This means that all the initial expenses & revenues run through the StartupBros credit cards & bank accounts…

This allows me to retain the tax & liability advantages of having an LLC, without creating the additional administrative workload of having yet another separate LLC.

But once the new startup is profitable (and if I decide to keep running it), I will then go file for a separate LLC and set up a separate set of credit cards, bank accounts & accounting system (quickbooks).

What if you don’t already have an LLC or Corporation? Then you just need to think about when you’d like the advantages to kick in…

If you have significant assets (like home equity), then you may want an LLC immediately…

If you don’t have any significant assets, then you might want to wait until the tax advantages of an S-Corp kick in (around $100k annual business income).

But honestly, there’s a lot of advantages to having at least one LLC. What’s annoying is having 10. So I personally would file for my first LLC sooner rather than later…

The only other consideration will be fees associated. Different States will have different fees & requirements. So you’ll need to research the details of opening an LLC in your specific State (check current LLC filing & renewal fees here).

PROTIP: Don’t get distracted by the concept of filing your LLC in a State separate from where you live (Wyoming, Delaware, etc). You will still need to file for an LLC in your home State anyways (as a ‘foreign company’). There are niche benefits to these strategies, but saving money in the early days of your business is NOT one of them.

So if you live in a State like Iowa or Arizona – it’s only going to cost $50 to file for an LLC, with no annual recurring fee. That’s a no-brainer…

But for those of you living in California ($800 per year) or Massachusetts ($500 per year), you might want to validate your idea just a little bit more before finally filing for an LLC.

NOTE: Some 3rd-party marketplaces give sellers a hard time when changing their Tax ID from an individual to an LLC/Corporation. But for the most part, it’s an easy process to make the switch.

Read my full breakdown on optimal setup for LLCs and Corporations here.

When You WANT a Business License

You only want a business license when it’s absolutely necessary. And in most cases, they won’t be – since in most of the world, there is no such thing as a ‘license to sell’ or a ‘license to do business’.

While there are specific product categories that do require licensing (alcohol, firearms, etc), most new entrepreneurs will never need to worry about business licensing.

If you suspect that you live in an area that has business licensing requirements (or are selling a sketchy product that may be regulated), go back and read above (specifically the part about how to check for this on Google).

It’s usually worth a quick check…

It’s also worth it to mention – I know many business owners who have owned their companies for decades before realizing they need a specific type of business license. And none of them are in prison.

The local tax authorities (usually) aren’t there to kill your new business before it’s even started. They actually want your business up & making money…so they can tax it!

So while it’s certainly your responsibility to make sure your business is properly licensed, it’s even more important to make sure you actually have a successful business.

When You WANT a Sales Tax Permit

As discussed earlier – if you’re only planning on selling via 3rd-party marketplaces (like Amazon, Etsy, or Walmart), then you technically don’t ever need a sales tax permit…

However, that doesn’t mean you won’t want one for the other benefits they provide:

- Tax-free inventory purchases: You can bypass sales taxes by providing your sales tax permit to wholesalers, manufacturers, and even retail stores (Walmart, Best Buy, NewEgg, Costco).

- Reputability: You often need to provide a sales tax permit to open up accounts with wholesalers or start working with manufacturers. Most won’t take you seriously without one.

Many sellers find that these benefits are worth the cost, so this may be something you want relatively early in your e-commerce career.

However, just like everything else we’ve talked about – registering for a sales tax permit will create fees & paperwork for you…

Although there is often no fee for registering for a sales tax permit (check sales tax permit costs here), you will always have filing requirements (which means fees/penalties for missing/late filings).

But if you’re making any type of sizable inventory purchases, this will be worth it early on in your journey. Perhaps even from the very beginning.

Platform Specific Rules

Amazon Specific Policy & Advice

Both individuals and corporations can be Amazon Sellers.

You will be asked for a Tax ID when opening a new Amazon Seller Account. That Tax ID can either be your personal one (your social security number), or it can be your company EIN (employer identification number).

You can start as an individual seller, then switch your tax information & account ownership over to a corporation in the future. This can trigger account verification issues, so it’s recommended you do this relatively early.

Amazon is a ‘marketplace facilitator’, which means they are required to collect & pay sales tax on your behalf. So you will not be asked for a business license or sales tax permit.

Etsy Specific Policy & Advice

Both individuals and corporations can open an Etsy Shop.

You’ll be asked to sign up either as an ‘Individual’ or ‘Business’. Individuals need their social security number, while Businesses need both their EIN (employer identification number) and Business Registration Number (you’ll get this when registering an LLC/Corporation in your State).

You can start as an Individual seller, then switch over to a Business account in the future. This can trigger account verification issues, so making the switch sooner is better.

Amazon is a ‘marketplace facilitator’, which means they are required to collect & pay sales tax on your behalf. So you will not be asked for a business license or sales tax permit.

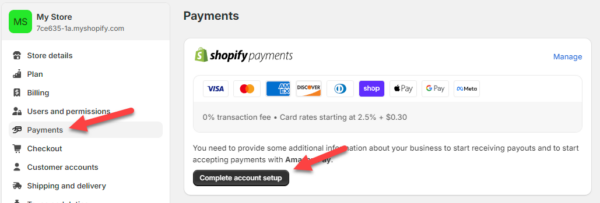

Shopify Specific Policy & Advice

Both individuals and corporations can open a Shopify Store. In fact, you won’t be asked for any legal or tax information at all when setting up a new store.

Instead, this is handled at the ‘Payments’ level. Whichever payment processor you choose will ask for this information instead (as they will be the ones reporting your sales to the IRS).

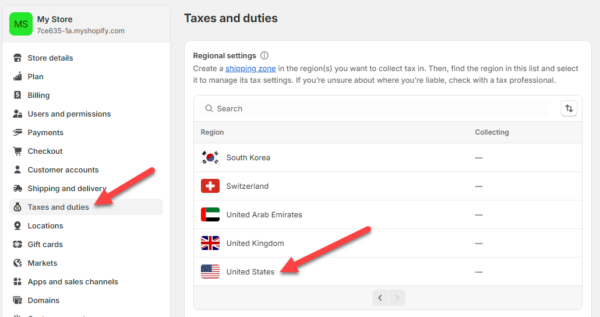

Unlike 3rd-party marketplaces like Amazon and Etsy, Shopify is not a ‘marketplace facilitator’. So you are responsible for collecting & paying sales taxes in all States which your business has nexus in.

When you’re first starting out, you’ll probably only need to set up sales taxes in the State you & your business live in. You can do this in the ‘Taxes and Duties’ menu…

Most Shopify sellers use the ‘Shopify Tax’ service, which should be enabled by default. From there, select the country you’re trying to set up sales tax collection in.

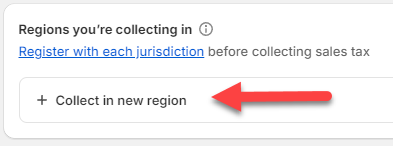

Then click on ‘Collect in new region’.

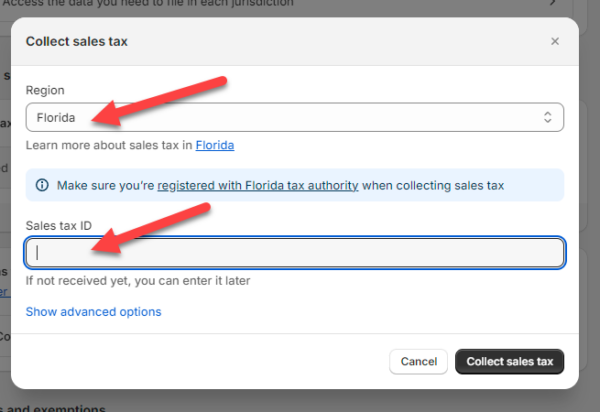

You’ll be able to select whichever State you want to collect sales taxes in, and also input your Sales Tax ID for that region.

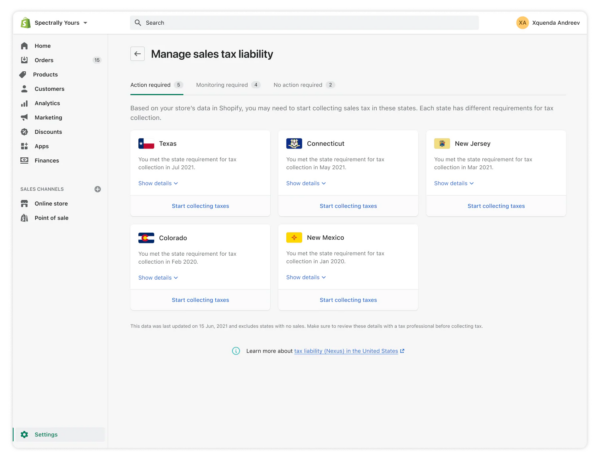

For US & Canada based sellers, you’ll also notice your potential Sales Tax Obligations on this page. Shopify also gives you an extremely handy dashboard to monitor when you might trigger nexus in new regions.

I have registered an LLC in NY to do online business on Amazon. My profile name on the account though is different from my LLC’s name. Do I need to file Doing Business As (or assumed name) paperwork with the state for my amazon seller profile name?

Yep, if you’re operating on Amazon under a name that’s significantly different from your officially registered LLC name, New York would require you to file a “Doing Business As” (DBA) to keep everything above board.

The main thing I don’t understand in the article is why a DBA was needed for startupbros.com? Startup Bros LLC is the business so would it have to be startupbrosllc.cim in order to avoid registering a DBA, or is it just that state’s rules to register a DBA when using a website?

No DBA was needed for StartupBros.com, as the company name is StartupBros LLC (and the LLC part is just there out of legal requirement, not in the actual name of the LLC).

DBAs are more about how your business is represented to the public and in transactions. If your brand differs significantly from the name of your LLC, you probably need a DBA. If not, I wouldn’t worry about it…

When you say, “….. no business until you start making money”, how much money are you talking? Is there a specific amount?

Personally I wouldn’t worry much about incorporating until $5k-10k in revenue (with decent profit of course), along with a strong belief the business will still be operating profitably in 6-months. But I am not a lawyer 🙃

There are exceptions of course (such as you having lots of assets in your name). So make sure to read that section of the article again!

I’m from Indiana (USA). I am trying to drop ship on amazon. For bank account deposit option I wanted to use a business account, but I don’t have one. I tried to open in my bank(PNC), but the need EIN and business license. I do have EIN number as a LLC, sole proprietor. But I don’t have license. What do you suggest?

The business license number (in this case) is likely referring to a document number on your Articles of Organization or Certificate of Status. For instance, in Florida each LLC is assigned a ‘Document Number’ which would be considered the Business License ID Number. I believe in Indiana it is called the ‘Business ID’.

Does Walmart allow individuals to open seller accounts too?

Yep, Walmart accepts either SSN or EIN as Tax ID (meaning you can sell as an individual). It’s also a ‘marketplace facilitator’, so they will handle sales taxes for you. So you should not need anything other than a Tax ID to start selling via Walmart.

If I sell on Poshmark, Mercari, or Depop, do I need a seller’s permit or business license? I am planning to buy goods from a wholesale on AliExpress.

I believe all those marketplaces will allow you to just download the app and start selling. Eventually you’ll be required to input some Tax ID (SSN would work just fine, so nothing required there). Since they are all ‘marketplace facilitators’, they will collect & pay sales taxes for you. So there’s technically no limit on how much you can sell without worrying about incorporating or sales tax permits.

As a registered corporation in Canada, do I need to get anything other than an EIN to setup a professional account on Seller Central (and then sell on the American Amazon platform)? And is it enough to just tell the IRS what your DBA name is while filing for your EIN? Do I need to register that DBA anywhere else? (I have no presence in the US, just the Amazon warehouse that will be fulfilling shipments from)

It should be extremely easy for you, as Canada/USA/Mexico are all wrapped into a single ‘North America Unified Seller Account’. I believe you can even get set up on Amazon Canada first, then seamlessly get set up in Amazon USA.

There may be some filing required at some point, but I am not even sure there would be. Definitely nothing that would stop you from getting up & selling. Work on that, and then deal with any issues that arise as they happen. But I think you’ll find it’s easier than you’re expecting since they’re all wrapping into the one North American Unified account.

I’m thinking of converting my soap making hobby to a part time business selling these on online marketplaces such as Etsy, Facebook Shops etc. Correct me if I am wrong, but as far as I know we do need a license/permit to sell these, but I guess we can skip the business registration entirely. Given the fact that these are cosmetics it might be better to structure the business as an LLC with some insurance around it. If it were you, would you consider selling these first to test the waters and then if it is profitable (then go through the various hoops of registering an LLC, getting the insurance, etc?)

Etsy & Facebook Marketplace are not going to require any business license to sell soap. But there may be local business licensing that are required. I personally would test the waters and get it profitable first, then worry about legal structure & insurance once you know you have a good business on your hands.

I’m thinking of selling Items on amazon, I know I don’t need a business license but as far as the sales tax is concerned, do I need to get a permit from each state, or does amazon collect the tax and send it to each state?

Amazon is considered a ‘marketplace facilitator’, and is required to handle sales tax collection & payment for you. There was a Supreme Court Case (South Dakota vs Wayfair) that recently forced this change. Previous to that, it was your responsibility to handle every individual State on your own. Now it is MUCH simpler.

We have a supplier in California who is asking for a California resale certificate. We don’t have an LLC and we are residents in GA. What do we need to do to get a CA resale certificate? Do have to register our business first in GA?

I would contact the supplier and tell them your company is based in Georgia and has a sales tax permit there, but has not met the threshold to require one in California yet. They should not mind.

I’ve already registered as an LLC. I have a manufacturer who is supplying to me and I am reselling those products under my brand. While listing the product on Amazon, it asks for “Manufacturer” in vital info. Am I supposed to enter my brand name, or the name of my supplier?

From Amazon’s point of view – if you are selling the products under your brand name, then you are the manufacturer. Just like Nike is technically the manufacturer of their shoes (not their actual overseas factory).

You typically will not need to reveal supplier details to Amazon (though there are exceptions).

I am a US citizen living in the UK. If I only ship to and sell on Amazon US, do you know if I need to worry about UK business registration or taxes? Or if as a US citizen, I would only need to worry about US rules still, as long as I’m not shipping and selling in the UK? I have a US bank account to use and transfer revenue into.

If your business operations are based in the US (using a US bank account, selling in US markets only), you’d generally focus on complying with US tax laws & regulations. But the UK may have tax implications for residents with overseas income, so talking with a tax pro with relevant experience would be smart as your sales start to grow.

I’ve heard Shopify will hold your funds if you can’t prove you’re a business. What documents would I need to have in order to legally sell via Shopify (my State is Virginia)? I don’t want an LLC until I know I can make sales…but will not having the LLC stop me from selling per Shopify terms of service?

While there are various reasons Shopify (or any payment processor) might hold your funds in reserve, not having a corporate entity is not one of them.

You do need to provide some type of tax information (as Shopify needs to verify your identity & make sure you’re not just laundering money). If you can’t provide any tax information, they can’t send you your money.

So if you are a US Citizen or Resident with a Tax ID (like a social security number), you should not run into any issues starting out as a Sole Proprietor and switching over to an LLC/Corporation later.

They only hold funds for the first 90 days and they amount they hold is something around 20-25%. I believe the hold has to do with verifying your bank info.

I’m launching an activewear brand to sell on Amazon. I’ve bought the domain name for this brand, but I don’t have any business license yet. I have a Chinese factory that I’ve partnered with producing & shipping the product to the US for me, all products customized with my own brand logo.

What’s the best way for us to launch this brand? Do we need to register the trademark in the US with my partner’s Chinese Company name?

It depends on if you and your Chinese factory are actually business partners on this brand, or if you’re simply using the factory to manufacture your new brand’s products.

99.9% of the time, you and your Chinese factory are not engaged in anything more than a transactional business relationship. In that case, the US trademarks would be filed under your brand’s LLC (or your own name).

In fact, even if you and your Chinese factory were engaging in a deeper equity-based partnership – the US trademarks would still be filed under the US brand’s LLC. But again…99.9% of the time, you are partnering with a factory to manufacture things (not engage in any type of deeper business partnership). At least initially.

Do I need a registered business to sell in Amazon as non us citizen

Amazon.com only requires a Tax ID number. For non-US Citizens, this usually means an ITIN (International Tax Identification Number) – https://www.irs.gov/individuals/how-do-i-apply-for-an-itin

Our company is engaged in Amazon retail, the main market is the United States. In the recent two months, it is easy to trigger the audit by registering an account on amazon. Some accounts have been audited for nearly a month without any news. My question is: is there any way to purchase the amazon store registered by an American company? I’d like to buy idle accounts.

Two ways to do this – the right way, and the sketchy way…

Right Way: You can buy an existing Amazon business from a platform like Empire Flippers, Flippa, or BizBuySell and keep running/expanding the store.

Sketchy Way: You buy inactive Amazon accounts because you engage in non-TOS compliant behavior and keep having account suspended. There are niche forums, discord & telegram channels where you can buy these, but I have no real experience with this. I think it’s a losing strategy (just spend all that time & energy on something that will last 10+ years instead).

I am trying to sell on amazon. What do I do first? I buy the goods from Alibaba and inform them that I’m selling on amazon? Or I create my account on Amazon first? I picked a product and have a supplier, but I am afraid of taking the next move as I don’t know where to start. I also need to know if I am an individual seller and I don’t live in the states but I have summer home in California I come every year in the summer for only 2 month do I have to pay taxes? Amazon don’t have my country in their list so I have to put my American home address and I have personal bank account here and yet I don’t have SSN?

You don’t need to inform Alibaba (or your factory) you’re selling on Amazon – they don’t care where you sell your products. Since you already picked a product and selected a factory, I’d say the next step for you is to create your actual Amazon account. You’ll find it’s easy to work through most of the questions you have by just going through the process. If you own real estate and spend time in the US, it should be no big deal to register for a TIN (Tax ID Number). Specifically you’d probably want an ITIN. You will certainly have to pay taxes, but I wouldn’t worry about that until you’re selling products and actually have a tax liability.

I live in US with work visa and would like to open an individual account and sell some stuff on Amazon. Since I have SSN through my job, will it be an issue for me to start selling on Amazon? I’m doing individual because I won’t be selling more than 40 items per month.

All Amazon wants is your US Tax ID, and your SSN certainly qualifies as one. So you should not have any issues opening up a new seller account and starting to sell through those items.

I create garden art from upcycling and repurposing mostly household items. I set up a Facebook Business Page and Instagram Business Site, and I’m selling via FB Marketplace.

Can I still use a business name for these sites, without a license? I didn’t trademark my name, but have been using it for a month or so.

If I’m understanding correctly I do not need a federal, state, County or City Business license for these types of sales, correct? I also would like to know if the State wants to know all of the income made, do they factor in the cost of materials, and tools to do my job? I somehow need to make up that money to pay my credit card that these things were charged on.

I’m not an attorney and nothing I say is legal or tax advice. But I’ll give my thoughts…

So from what I understand from your questions. You are selling art and created a Facebook Page and Instagram to promote your art (and you’re selling the art via FB Marketplace).

Now, to answer your questions:

1) You’re fine using a brand name on your FB/IG without first registering for any license or trademark. In fact, US Trademark law says that your brand name is automatically created as an ‘unregistered trademark’ the moment you start using it commercially. You can eventually register your trademark for additional benefits, just like you can eventually incorporate your art business as an LLC to enjoy those additional benefits. You can also file something called a DBA to tell the State you’re ‘Doing Business As’ another brand name, which I believe is technically required (though very few people actually file DBAs every time they use a new brand name online).

2) Facebook Marketplace is not going to ask you for any type of business license or permit to sell. However, your local jurisdictions (city/county/state) may have rules & requirements that don’t exist elsewhere. This is again a situation where you are probably safe to get started without proper licensing, but will need to figure it out as your business grows.

3) The IRS/State wants to know about all income made from all sources. However, you have to keep in mind the definition of income – which for business owners is usually the net profit of the business. If you sold $2k worth of products and spent $2k on materials/inventory/shipping/etc, your income would be $0 – and you would have no tax liability. So you keep track of all of this (usually via something like Quickbooks), and report to them what you owe at the end of the year.

We are a company based in UK and would like to sell products on Amazon USA. Wondering if it’s better to open a company in USA or apply as foreign company. Is there are tax different if a company is in USA or UK?

Correct, you either need a US legal entity (LLC/Corporation) or to register with the IRS as a foreign company. Amazon does not require you to have any physical presence in the US (you can check their list of approved countries), but they require a US Tax ID (which means you’ll need to register for an ITIN or as a foreign company for an EIN anyways). The two tax forms relevant to his are W8-BEN-E to obtain an EIN and then you need to file 1120-F annually.

Honestly I do not have personal experience with this, since I am from the US. But this article is a great place to continue your research.

Here’s what the IRS website says about EIN Eligibility –

– You may apply for an EIN online if your principal business is located in the United States or U.S. Territories.

– The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN).

– You are limited to one EIN per responsible party per day.

– The “responsible party” is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Unless the applicant is a government entity, the responsible party must be an individual (i.e., a natural person), not an entity.”

How can someone from outside the USA apply for an EIN without a SSN?

You would first need to obtain a US Tax ID (probably an ITIN in your case). You can read about all the Tax ID’s and how to get them here (IRS site). Look into both the Form W7 mentioned on that page, and also the form W8-BEN-E. I believe both may be relevant.

But once you have an ITIN, you just simply apply for an EIN. You don’t need to be a US Citizen, US Resident, or have any type of legal status in the US to get an EIN. You get this via form SS-4 (read about it here).

As of me writing this, the online process for obtaining EINs is only available to US entities. So if you’re non-US, you would need to apply via Fax or Mail (I believe they require some extra info also, such as a passport scan).

I’m one of those “get your ducks in a row” people, but I intend to start selling on amazon this week!!! I would like to start with retail & online arbitrage then move on to wholesaling and private labeling.

I would like to go ahead and get my LLC because I have read that in order to switch my seller account name to my business name Amazon can potentially freeze my sellers account while approving potentially losing $1,000’s in sales. If this is true, wouldn’t it be better to go ahead and put in the LLC name originally instead of using my own personal info to avoid this or am I getting some of the bad info that is out there?

It’s true that you’ll sometimes have to go through the identity verification process over again if you switch owners on the seller account (including from yourself to your company). So it’s certainly worth it to do it sooner rather than later. Especially if you live in a State where it’s cheap & easy. People living somewhere like California are more incentivized to hold off for a longer period.