Note: Our clients use Mark’s software, we use it, and we recommend it for anyone involved in e-commerce space in the US. Collecting sales tax online can be a nightmare to deal with, which is why we love Mark since he’s made dealing with this a breeze.

There’s no feeling like starting your own business and finally controlling your own destiny.

You feel unstoppable – until some tiny administrative hassle throws you for a loop. And one of those administrative hassles with a lot of potential to derail your progress is sales tax.

You probably have a pretty good idea what sales tax is from the buyer’s perspective.

A customer makes a purchase online and the merchant adds a small percentage of sales tax to the sale.

But when you’re the merchant, things start to get trickier. Everything from who to charge, how much to charge, and what to do with all the sales tax you collect isn’t so straightforward.

This guide will demystify sales tax for online sellers. So you can get back to doing what you do – running your kick-ass business.

Here’s What We’re Covering:

What is Sales Tax?

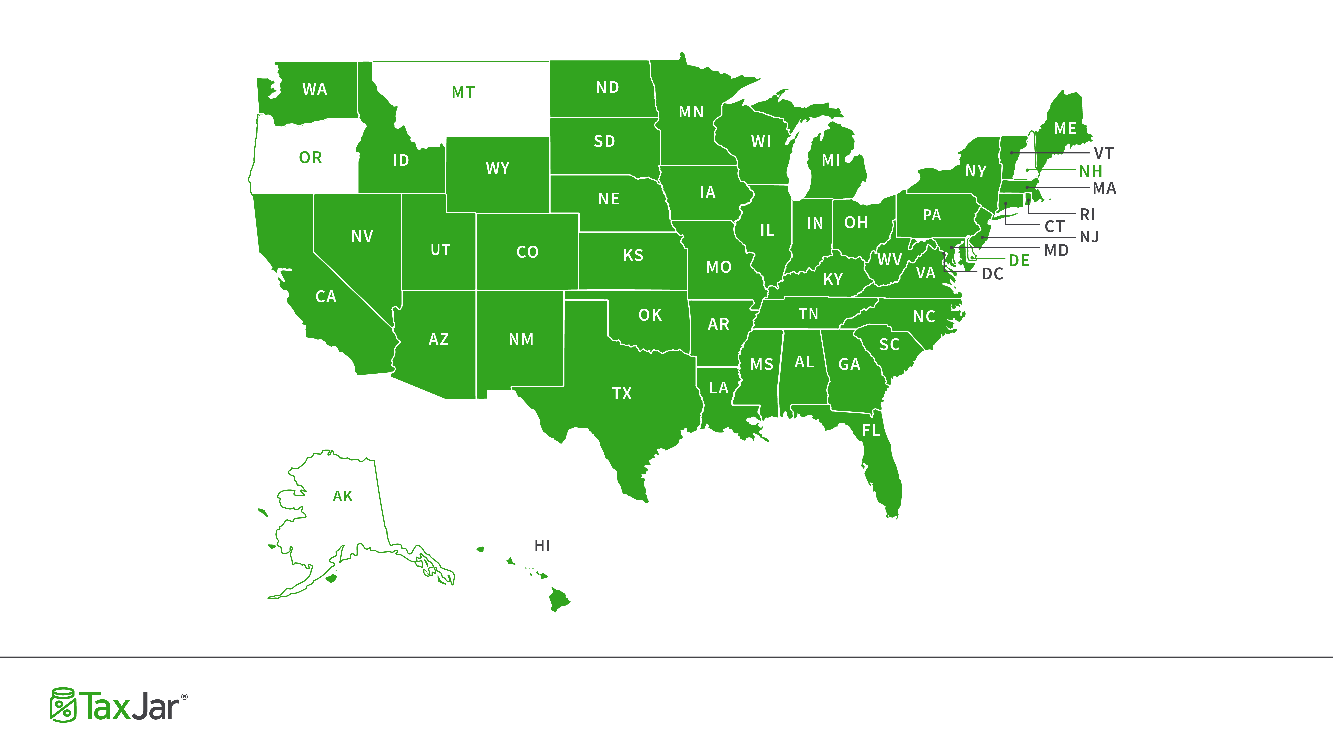

Sales tax is a tax charged by the seller to the buyer. It needs to be reported when filing your business taxes. Forty-five states and D.C. all have a sales tax. There’s no IRS for sales tax.

The state level handles sales tax and it’s managed by the state’s taxing authority (usually called the “department of revenue.”)

Sales tax rates can vary from state to county to city. Online merchants are required to charge sales tax online on tangible products like books or furniture.

But that’s starting to change as some states want to tax services, too.

The key thing to remember here is that states get a large portion of their revenue from sales tax. This means they’re becoming aggressive about ensuring merchants are collecting.

How Do You Pay Online Sales Tax?

Step 1: Determine Where You Have Sales Tax Nexus

Sales tax nexus is just a way to say “significant connection” to a state. If you have nexus in a state, then that state requires you charge sales tax to buyers in the state.

You’ll always have nexus in your home state.

But you may find that certain business activities create nexus in other states, too. They include:

- A location – an office, warehouse, store, or other physical place of business

- Personnel – an employee, contractor, salesperson, installer or other person doing work for your business

- Inventory – Most states consider storing inventory in the state to cause nexus even if you have no other place of business or personnel

- Affiliates – Someone who advertises your products in exchange for a cut of the profits creates nexus in many states

- A drop shipping relationship – If you have a 3rd party ship to your buyers, you may create nexus

- Selling products at a tradeshow or other event – Some states consider you to have nexus even if you only sell there temporarily

To help you determine whether or not your business activities give you sales tax nexus, you can find out what every state’s laws have to say about nexus here.

Once you’ve determined that you have nexus in a state, your next move is to get registered with that state.

Step 2: Register for a Sales Tax Permit

Always register for a state sales tax permit before you begin collecting sales tax online. Most states consider it unlawful to collect without a permit.

(In their deepest suspicious you could be a villain who tells customers you’re collecting on behalf of the state but really just pocketing the money.)

You can find step-by-step guides on how to register for a sales tax permit here. Or you can hire a sales tax pro to register for you.

When they issue your sales tax permit the state will also issue you a sales tax filing frequency (usually monthly, quarterly or annually.)

Hang on to that information for steps 4 and 5.

As soon as your permit is in your hand, it’s time to start collecting from customers.

Step 3: Collecting Sales Tax Online From Customers

Next make sure that you’ve set up your shopping cart of other sales platform to collect sales tax from the customers in states where you have nexus.

If you sell products at a brick and mortar store, your sales tax life is fairly simple. You’d just charge your customers the local sales tax rate at that spot. But online sellers have a more difficult time of it.

Most states are “destination-based” sales tax states, meaning you are required to charge sales tax online at your buyer’s ship-to location. Since rates can vary from locality to locality, this can get complicated fast.

Fortunately, most online shopping carts have built in sales tax functionality (some better than others.) You can find out more about setting up sales tax collection on the most common shopping carts here.

If you’re an online seller with multiple channels, be sure to set up all of your shopping carts to collect sales tax from buyers in all of the states where you have nexus.

Step 4: Report How Much Online Sales Tax You’ve Collected

When your sales tax filing due date approaches, you’ll need to figure out how much sales tax you’ve collected from which customers in which states.

Sadly, the complexity doesn’t stop there.

While a handful of states make sales tax simple, most rely on you, as the online seller, to report how much you collected.

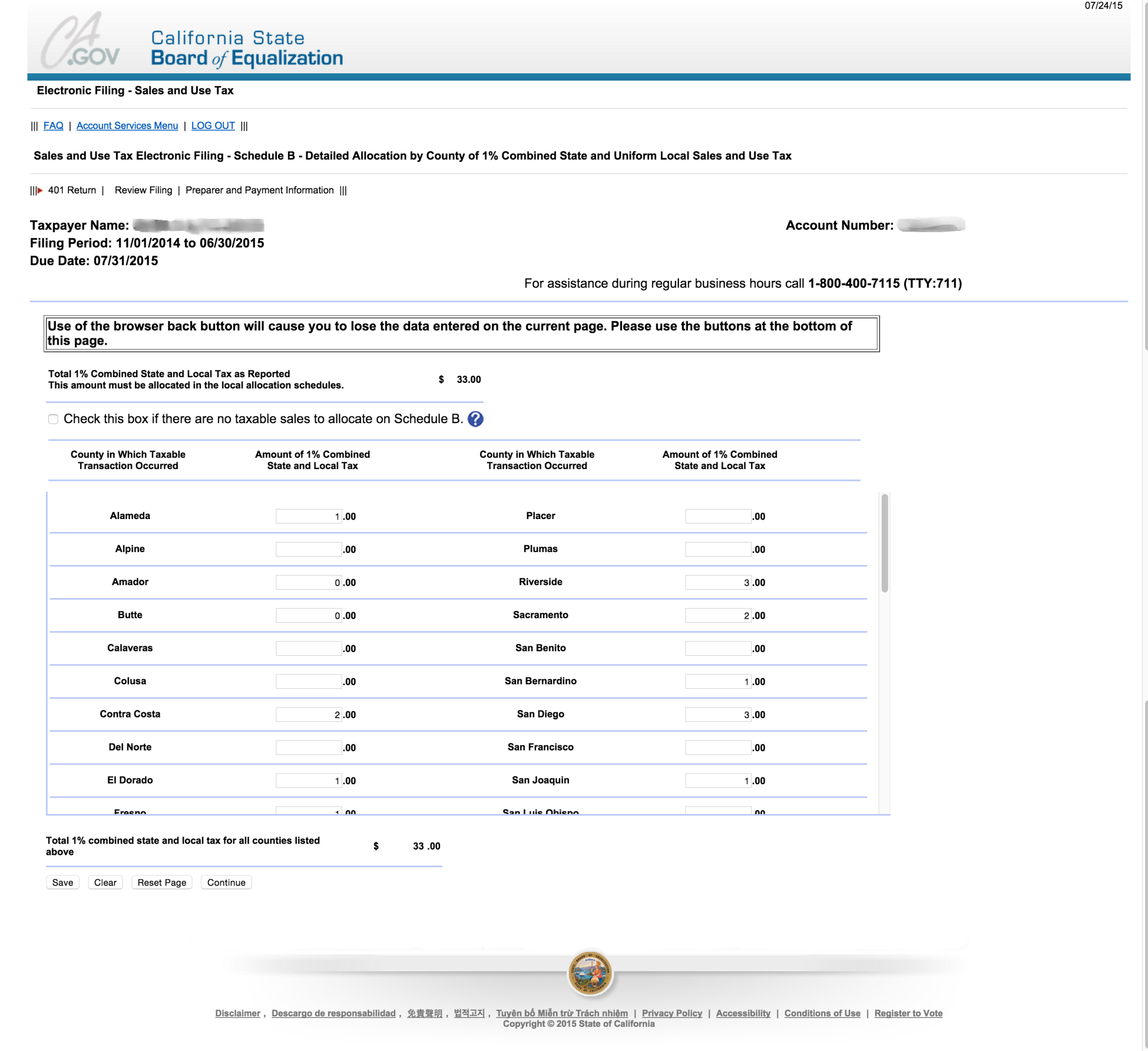

Not just in the state in general, but how much you collected from buyers in each county, city and other special taxing district.

For example, here’s just a small portion of what California wants to see from online sellers:

That’s where sales tax automation comes in. With apps like TaxJar, you can connect all your shopping carts and other channels with one-click and then have these reports automatically filled out for you.

Before we created TaxJar we heard horror stories of teams who huddled together in a room over the weekend to get sales tax filing done. You don’t have to be that startup!

Once all that is finished, your next step is to actually file and send that sales tax to the state.

Step 5: File Your Sales Tax Return(s)

You’re almost to the finish line now! The next step is to actually file your sales tax return and remit the sales tax you collected to the state. You can either login on the state department of revenue’s website or let TaxJar AutoFile your sales tax returns for you.

Either way, make sure to keep these couple of things in mind:

- File “Zero Returns” – If you have a sales tax license in a state, file a return by your due date even if you didn’t collect any sales tax in that state over the taxable period. Failing to do so can result in everything from a $50 fine to having your sales tax license revoked

- Don’t Discount Discounts – About half the states will allow you to keep a small portion of your sales tax collected if you file on time. Here’s a list of states that offer sales tax discounts. If you AutoFile with TaxJar, we’ll do the math and make sure you keep your discount.

And that’s it – you’ve mastered sales tax for online sellers. You’re all done until the next filing deadline comes along.

Wrapping This Up…

If you have questions or comments, you can find out way more than you probably ever wanted to know about sales tax in our TaxJar Sales Tax 101 Guide. Or start the conversation in the comments!

TaxJar is a service built to make sales tax compliance simple for eCommerce online sellers. Try a 30-day-free trial of TaxJar today and eliminate sales tax compliance headaches from your life!

Additional Resources:

How to Sell on Amazon: The Ultimate Beginner’s Guide to Starting Your Business

How to Get Your Amazon FBA Business Ready for Tax Time (2017)

Do you need to get a sales tax permit/worry about sales tax on day one of selling on Amazon?

Check out this guide Jon, it goes deep on business license & sales tax permit needs when getting started on different platforms.