I’ve tried and failed to write this article ten times.

Even after I finished, I thought it was terrible–actually I was just scared to share the story. I sent it to a reader who had asked me about trading. He replied:

“It’s different than most that I have read because there is no bullshit to try and look past and all of your readers appreciate that.”

Thanks Garrett, here goes nothing:

A Kind of Introduction To Day Trading

This is about the lessons I learned while trading. The pitfalls people fall into and the ways people destroy themselves. There’s also the time I raised money for a hedge fund. Then my partner turned $30,000 into $2,000,000 in three months. It only took him two months to turn $2,000,000 into virtually zero.

We’ll get into the details later.

I mean trader as in “day trader”. From the time I was 15-22 I sat in front of 6 computer monitors watching charts go up and down. Why am I not doing it now? I didn’t make the billion dollars before hitting 22.

Traders are unique in that they might be the only group of people more delusional than entrepreneurs.

I say this lovingly.

According to my calculations, there’s no reason I couldn’t have made a billion dollars day trading. Never mind that 99.9% of traders are losers. Forget the fact that 80% of traders are depressed middle-aged men going through their mid-life crisis. (I saw one in the local library yesterday, he looked like he was avoiding his wife. I saw another today at Starbucks, he didn’t buy a drink and he smelled funny.)

I was the exception. I was going to get my billion-dollar pay day before my 30th birthday.

And I actually was the exception. I made a nice chunk of money before stopping. I treated the thing with respect—not some get-rich scheme.

It breaks my heart when I see people tell me they day trade and then see them following some bullshit newsletter or some coach with a fudged track record. When I see someone watching another FOREX algorithm sales pitch or drooling over some penny-stock report I just want to shake them and say You have potential! Stop letting yourself get scammed! Stop scamming yourself!

If you trade without the proper preparation you’d be better off in Vegas. This is not an exaggeration. Not only are there free drinks, sexy ladies looking for fun, and an obscene selection of Cirque du Soleil shows… your odds at pretty much any casino table are better than the markets. I mean this literally (like “literally” as defined by a dictionary)—you are guaranteed to lose money over any decent period of time unless you learn to trade well.

And then even once you’re prepared and you feel you know everything there is to know about the markets, you’re still not guaranteed to win. That’s just the nature of the beast.

That’s why I started meditating at 16. Trading is intense. In college I would make $5000 in the middle of class and then lose $10,000 a few hours later while watching a movie.

That kind of thing gives you a different perspective on money.

One last thing before we get into the meat of the post: Like Garrett said, this is probably different than anything else you’ve read on trading. Why?

- I don’t want to sell you anything. I don’t give a shit if you trade or not. Actually, I would almost rather you not trade… most people would be better off spending their life doing other things.

- I’m not currently trading. I’ve double-checked my methods and they still work, so the information is current, I’m just not spending my life using it.

- The focus isn’t on the method—although I’ll give you all the dirty details. You’ve got to be fluid as a trader. The top hedge funds in the world hire mathematicians, physicists, meteorologists… they are constantly shifting algorithms. How do you compete with these people? You don’t. This will make more sense later.

- I don’t have any stake in you listening to me. For real: nothing is for sale. I’m not going to teach you to trade. People that teach people how to trade or run newsletters giving trading ideas make more money by selling their ideas than using their ideas. They all have their own stories about why they are being so generous with their SECRET knowledge but it’s bull. (Not that all this information is bad, it’s just that you got to be careful—don’t follow anyone blindly.) (Wait, so what are my incentives for writing this? I just want you to like me—I want you to like me and this article so much that you subscribe for our newsletter and I can write more things. Also, I’ve been thinking about writing this for way too long and I had to do it.)

- I’m not trying to convince you the world is ending.

Okay okay it’s time for the meat and potatoes.

Meat and potatoes? Ha! You’ll be eating liquid gold with the information I’m about to give you! Yes, you too can be a Rich Kid of Instagram!

Just kidding, you probably won’t do anything with it. (And that’s probably a good thing.)

Someone did make $2,000,000 with this information though. For real, I watched it happen.

Before we get to that story, we’re going to go through some of the major pitfalls new (and experienced) traders fall into.

[Note: I’ve provided the meanings of some words but I’m going to leave the glossary work to you, Google, and other places on the Internet that like defining words more than I do.]

What Not To Do

Why start with what not to do? Because not smoking cigarettes is more healthy than eating all organic. Because if you lose all your money then trading becomes kind of impossible, doesn’t it?

“You can do a lot by avoiding bad as opposed to seeking good.” – Paul Graham, founder of Y-Combinator

DO NOT: Use Real Money Before You Know What The Hell You’re Doing

Warren Buffett’s #1 rule in investing is to keep your capital. He says that his regrets have mostly been acts of omission instead of commission. That is because he doesn’t throw money at something that he doesn’t think will work—and so he misses out on making money on tech bubbles but doesn’t lose his ass when they bust. (Honestly, Warren Buffett isn’t a trader… he plays the long term and hasn’t done anything but acquire massive companies—or huge pieces of them–for decades… he is one of the world’s best money-getters but not someone who will give you anything useful in trading.)

What does this mean for you? Paper trade before you put any of your capital on the line. (Paper trading is when you make trades with a fake account. There are tons of platforms you can use for this, I used TD Ameritrade’s Think or Swim.)

How do you know when to start putting money on the line? When a system has proven itself.

When has a proven system proven itself? For me, a month of profitable trading (and a statistically significant number of trades).

This infers the next DO NOT:

DO NOT: Day Trade Without A System/Method

If you’re trading willy-nilly you’re going to lose.

I don’t even know exactly what willy-nilly means, but if you have to ask if your trading would fall under the “willy-nilly” category, then stop trading right f*&#ing now!

You’re not George Soros, you don’t get to trade on your gut.

You don’t need an algorithm running on a supercomputer—but you do need some sort of system that won’t let you be an idiot.

You will tell yourself you don’t need a defense against being an idiot. This is you being delusional. Believe me. I betrayed myself too many times before committing to my systems. You don’t win every time if you follow your methods but you do do a hell of a lot better.

How Do I Create A System?

So what makes a good system? We’ll get into this more later when I show you the exact system I used (don’t skip to it, this post will be useless if you do that). For now, this will be helpful when thinking about how to approach your trading:

- Offense. It tells you exactly when and how to enter a trade. Maybe it’s “3 of the 5 requirements must be met to invest 1 share, if 5 of 5 are met – 2 shares”. This is one line of emotional defense: trading will make you think that you can make a million dollars today, this is very exciting, you will want to fudge the rules. Warren Buffett only broke his rules when he got bored—notice when you’re bored. If you think you can take advantage of more opportunities in the market then alter your system, test it, and implement it. Remember: no willy-nilly!

- Defense. It tells you exactly how to exit a trade. This means stop losses. (These are orders that automatically get you out of a trade when the market you’re in hits a certain price.) A common rule is to take 50% of your position (your money in the market) at a certain profit point, maybe 100% maybe 68.2% (this is a Fibonacci number that is extremely popular among traders). It also defines exactly how much of a loss you are willing to take on a certain trade. This must be determined before you enter a trade. If you don’t put a stop loss in your brain will justify your position over and over to you while your hopeful trade ends up losing you your house (and family). This is even more important than a strong offense—don’t go broke!

- Adding to a position. Sometimes you may want to make your position bigger as the market moves in your favor. You need to have a set of rules determining how you’ll do that.

- Don’t complicate it. Every tool seems so powerful, so prophetic! Early on I had a habit of adding signals that I would wrap up into my system. I theory they should make your trading better. Maybe it does for a Harvard physicist, it didn’t for me. The more complex I made my system the worse I did, over and over. I would start simple, screw it up by adding a bunch of things people recommended, then go back to the drawing board. The best method I ever used was dead-simple (that’s the one we’ll get to in a little bit).

- Give yourself a ton of room for failure. Eight out of ten trades failed for me. That was fine because when I hit a winner it won big. But if you’re averaging eight out of ten trades failing, then it will be common to fail 20 times in a row. I’ve gone through streaks of 40 failed trades in a row. You’ve got to be able to survive those. My recommendation would be to risk 1% (or less) of the money you’re willing to lose on each trade. That gives you 100 chances for failed trades before you go bust. It shouldn’t happen. (Of course, when I was twenty I was risking 10% on some trades… if I went bust it wasn’t that big of a deal.)

- It has to work. Again, test the damn thing. If it doesn’t make fake money then it certainly won’t make real money.

There is a time and place for throwing caution to the wind and just going for it. Trading is the worst place for that kind of bullshit. The adrenaline that comes from the potential of losing thousands of dollars in a minute is enough—you’re mission is to keep a cool head.

DO NOT: Get Big Fast

If you do this right, you have the potential for making a lot of money faster than any other method out there. (Excluding entrepreneurs who are insanely talented and simultaneously insanely lucky.) The potential—chances are it won’t go that way.

Chances are you’ll lose money.

Or you’ll make money, feel like a god, trade like a god, and lose all your money.

When you put real money on the line the game completely changes again.

You think you’ve tested your method. You’ve gone the first month and everything looks solid. Great.

Then you put money on the line. Shit gets real. You can’t seem to follow the system like you did in the test month. The market seems totally foreign again.

You don’t believe me, that’s fine. For you it’s different.

I don’t know how many times I told myself that. I’m different.

It doesn’t matter though, you’ll feel it the same as I did.

To save yourself some money though, trust me, start small.

DO NOT: Trade When You’re Emotional

I told you I started meditating at 16. It’s not because I was excited about being “in the moment” or that I was into Eastern philosophy. It was because if I didn’t I couldn’t trade. I’d mess it up.

James Altucher talks about how he created algorithms for each of his methods and then let them trade for him while he was depressed an losing everything. I wasn’t smart enough for this (and my methods inevitably had some level of subjectivity to them) and so I manually entered all my trades. (Entering a trade or “putting on a trade” or “entering a position” just means you’re buying (or selling short) into a market.)

James got to trade emotionally because he wasn’t actually trading.

If I got emotional then I would get silly.

You’ve got a system so this shouldn’t matter. But it so matters.

Imagine this: You’ve just gone long the corn futures market for 2 contracts. You’re up $5000 on a trade in two hours. Awesome, right? Hell no!

This is what happens in the two sides (side 1 and side 2) of your brain:

1. I want to take this $5000 off the table now, that’s a great win.

2. Yeah, but look at this pattern—this could be the BIG trade—this could be $100,000 if I add contracts.

1. Yeah, but it’s more important to conserve capital. $5,000 is a great win. Maybe I could just take half off the table.

2. Don’t blow it. That’s $50,000 instead…

1. Fuck. The system says to sell now.

2. Yeah, but the system isn’t perfect. You made it anyway—you can change it. You can feel it!

1. Yeah. But, the system…

And then on and on. I said “imagine” but that exact inner-dialogue is something I went through twenty times a day every day for a long time.

When did I make the right choice? (The right choice being following the system, not making money. A lot of people make money with a shitty trade and then think they have some special talent… of course they go bust within the quarter.)

I made the right choice when I let reason reign.

When did I make the wrong choice?

When I was either excited or scared. Both fear and greed will destroy you. (Immediate greed that overtakes your rational decision—which has longer term greed in mind.)

I’ve said this earlier, but it’s important to repeat:

A. Some days you will feel like a worthless human being who has done and never will do anything worthwhile. You will enter trades you aren’t supposed to because you’re afraid of missing out. You will exit trades before you should because your stomach is weak.

B. The next day you will make a winning trade and feel like a god. You will forget whatever it felt like to lose and you will make trades outside of your method. You will enter trades you shouldn’t because you have the feeling that you can’t do wrong (the market may validate you for a couple days and make the problem worse). You will stay in trades too long because you “know” that the market will turn in your favor—no way could you be wrong!

Your trading decisions need to come from numbers and predetermined rules. After years of deliberate practice and success you may actually get an intuitive feel for the market. Then begin introducing those feelings into your systems. Before then, no way José.

DO NOT: Trade Based on Some Purchased System or Newsletter

Listen, if someone has a really kickass way to make money trading they sell it to a hedge fund or use it themselves. They don’t sell it to you for five easy payments of $300.

That being said, there are some decent newsletters out there. The James Dines letter being one of them. It may be worth signing up for a couple, but don’t rely solely on them. Experiment with their information. Test their ideas against your method.

Do not follow them blindly.

Think about the incentives at work… there is nothing in your favor.

(This means, by the way, don’t follow the method below without testing it first. Just so you know–if I were actively trading it right now I probably wouldn’t have shared it.)

DO NOT: Get Caught Up In Stories

Your system either works or it doesn’t.

People will devise elaborate narratives around their ideas they want you to buy into. They will spend countless hours telling you about this thing and why it’s the next took to make you a millionaire.

They will scare you by telling you you’re going to miss out on the next big thing. They will tell you that you need them.

You don’t. You need a system that works. Incorporate their idea into your system if you believe in it, see if it actually works. If it doesn’t, take it out.

DO NOT: Trade

This isn’t a joke. Most people shouldn’t trade. If you’re not willing to give everything to the market then it’s not worth messing with. Do what Warren Buffett says and put your money in the Vanguard S&P 500 index fund and go about your life. (Or invest in your own business.)

Of course, as terrible as trading is, it’s also freaking awesome for the right people. To this day I get a warm fuzzy feeling when I see a price chart. I’m not joking. I feel at home and I see patterns and I get the urge to dive in… Maybe I will again. Who knows.

For real: you should only trade if you are extremely drawn to it and if you can behave rationally (while remaining delusional).

Alright. here it is:

The Method

I was on break before going into my junior year of college. I was trading, doing pretty well. I was having a particularly good morning when I received a picture message on my phone. It was a screenshot of my partner’s trading account.

A couple weeks prior I received one that said $250,000. He had started with $30,000 only a few weeks before. I was freaking amazed.

This particular day, though, I didn’t believe it was real. The image read: $2,000,000 (and change, whatever). That was a “holy moly” moment, to say the least. I stared at it for a long time.

I texted back, “This isn’t real.”

“Oh yes it is :D”

How did that happen?

How did he turn $30,000 into $2,000,000 in three months?

Well, the method below.

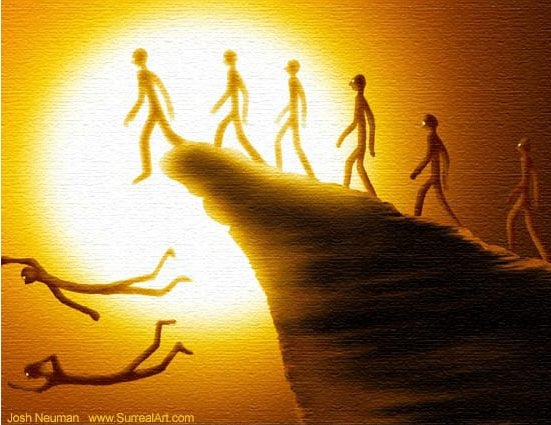

But also! (And this is a massively important “but”.)

- He was more balls to the wall than I’d seen anyone ever before. Every bit of profit was immediately thrown back into the trade so his position ballooned like crazy. I actually used the term “stapled to the wall”.

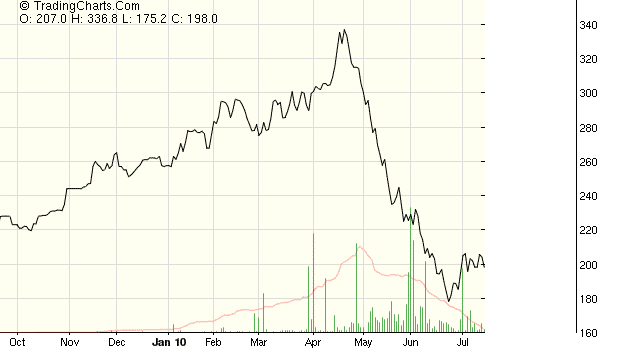

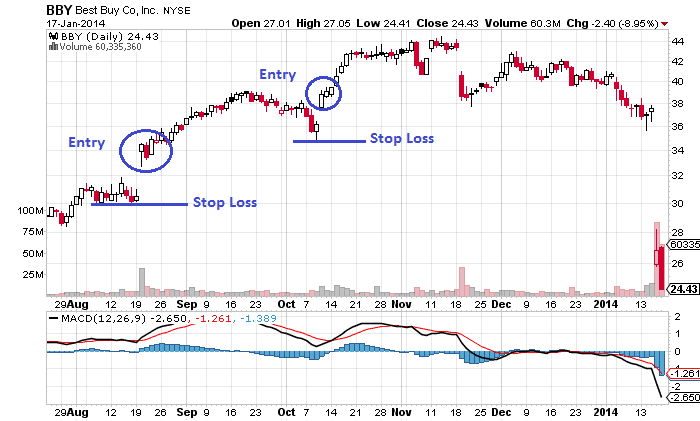

- He was insanely lucky. See that lumber futures price chart below? You see that massive move down? Yeah, he got that at the top and rode it straight to the bottom. (He had a short position—meaning he made money as the price dropped.)

- He does have mental powers.

This combination ended up with massive losses in the next couple months. He still ended with an awesome five-month return… but you were a millionaire for a month and then not… well, it hurts.

I used this method with my balls about a foot off the wall and made great returns. I nearly doubled my personal account in six months and then was able to raise money from investors with that track record.

[Note: This method is specifically useful for commodity futures but can be applied more widely with certain modifications.]

Here is what we looked for:

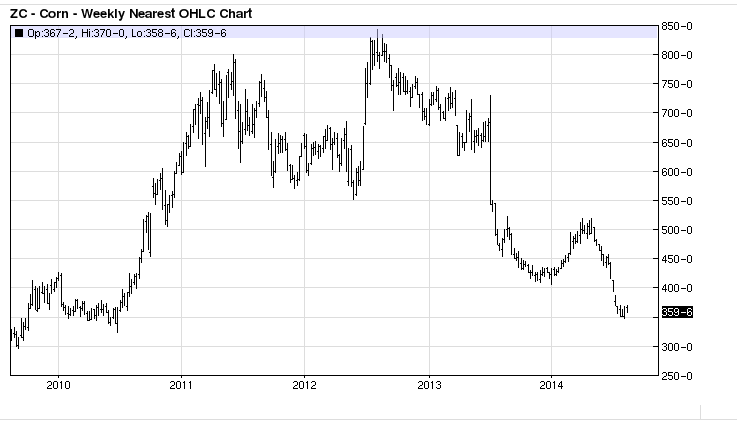

1. Multi-Year High or Low

This method required constant awareness of price movements but not a lot of action. With this method you probably won’t be making more than two trades a week—often you’ll make one every other week. It’s also a bit unique in that we are trying to spot tops and bottoms of markets, something that most people will tell you is suicide: “like catching a falling knife”.

I just looked up the Corn Futures price chart at barcharts.com and found it sitting right at a multi-year low.

This is a weekly chart (each bar represents one week) so we can see that we’ve missed the bottom last week. We can zoom in to see if that would have presented us an opportunity.

The first is the simplest, this is the first filter I use to sort through charts: is it at multiyear high or low? You can see this quickly and skip it if the answer is no. If it is then go in for a closer look.

(I will keep tabs on a bunch of charts sitting at these areas while I wait for the other requirements to be filled.)

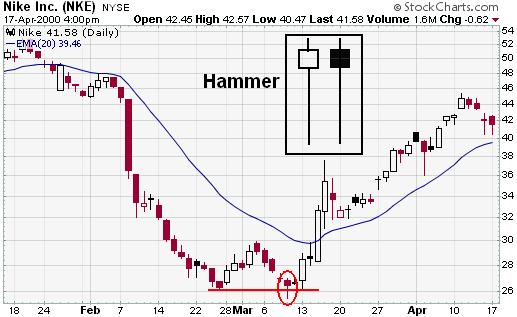

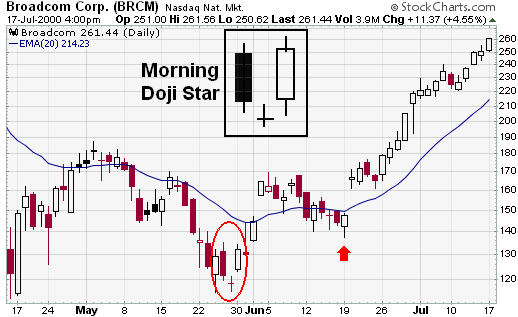

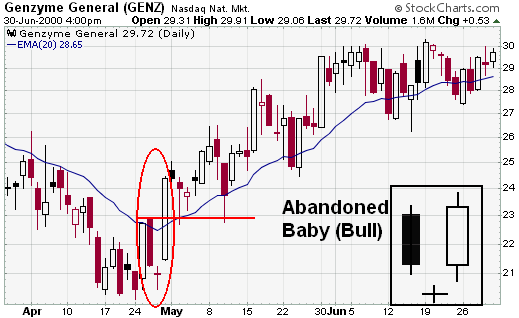

2. Hammer, Morning Doji Star, or Abandoned Baby Candlestick

[Note: I’m not going to get too technical here–just what you need to have a basic understanding and get started. I recommend you read everything at StockCharts.com’s Stock School if you have any sort of commitment to this. Candlesticks are just another way to view pricing information on a chart. An empty/white bar means that the price closed higher than it begun for the period of time measured by the bar. A red is the opposite, the bottom of the red bar is the closing price. The skinny area is the full area covered by price movement during the period covered by the bar.]

The second thing I would look for is a daily Morning Doji Star or Hammer Candlestick.

A Hammer Candlestick:

A Morning Doji Star:

Here is an Abandoned Baby:

Keep in mind we want these patterns at a multiyear high or low. Preferably with a gap. That means, for the corn chart above, we would want the price to open below where it’s current.

The gap shows one last push up. The two candlestick show consolidation of price movements. Basically, the price wasn’t able to follow through–signaling that this movement is out of gas.

Now, if you don’t see one of these right away, don’t discount it totally. Check for the third requirement.

3. The Producers Are On Your Side

General Mills buys a metric shitton of wheat. They move that market big time. It would be nice to know what companies like General Mills are doing so we could be on their side, right?

Yeah. And we can. And it’s pretty awesome.

Now, General Mills and other large producers use futures markets to hedge price fluctuations more often than trading for a profit like us. So we don’t take them with a grain of salt unless they are making significant movement.

Companies that trade over a certain amount of contracts are required to report the trades they make. These are collected in reports called Commitment of Trader Reports. You can get these reports here. You can get them in a more useful form (a chart) here.

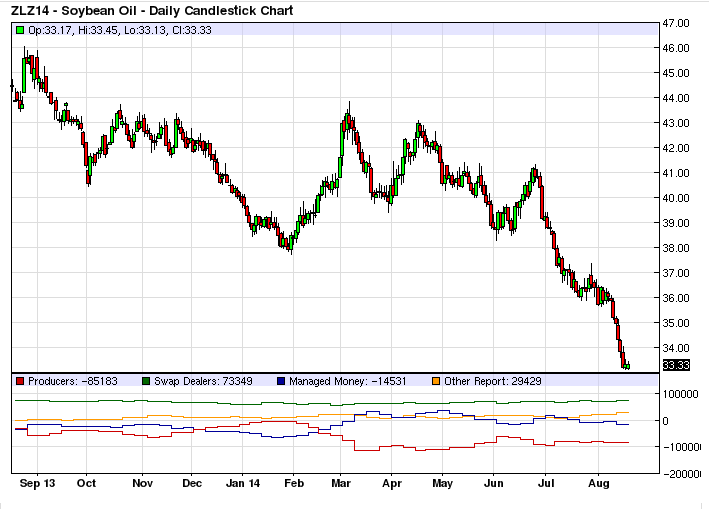

Let’s see an example. I just looked up a promising chart of Soy Bean Futures:

We can see a great multiyear low (which is more obvious in the weekly chart, note that this is a daily) and some consolidation. Okay, let’s see what the producers are doing–this information is available to us in the red line in the mini-chart below the main one.

We can see here (and on here-just CTRL+F “soy” and you’ll see it) that producers (the RED line) are still significantly short soybeans and they aren’t in any rush to get long (“get long” means to buy).

Because of this I’m not going to make a trade but I am going to keep an eye on this over the next few weeks to see if a cleaner setup emerges. (A setup basically means the boxes for your method are checked off.)

We want to see the producers make a significant move in the direction of our potential trade. Here I would want to see a large movement toward zero.

[This is a fascinating topic. Check out Trade Stocks and Commodities with the Insiders: Secrets of the COT Report, it’s freaking amazing. And if the $40 price tag looks too high, seriously reconsider trading as an option.]

4. (Optional: For the insane ones) Balls-to-the-Wall-Re-Buy

My partner was able to make such insane returns because he caught a great run and leveraged it to the hilt. He put on a huge position and then used all the profits from each movement to make his position even bigger. That means you’ve got to hit a home run.

I honestly can’t recommend anyone do that. This method alone demands more risk than most (even though you can use mini contracts to take smaller positions). I played more conservatively and did well. When I trade again, I’ll trade even more conservatively. Capital is the first requirement for trading–without it you’re out of the game.

5. Stop-Loss

You need to set a stop-loss immediately after entering your position. I would give different markets different leeway depending on how widely they fluctuated normally.

Corn might fluctuate 10 points daily on average while Crude Oil might fluctuate 20. I would give Oil more wiggle room (not willy-nilly, mind you!)

The most important thing is that you set a stop loss with a loss that you can manage. It doesn’t matter how perfect a setup might appear, it could still lose money. You need to be prepared to take losers.

Ideally your stop loss is below the previous low. Sometimes you won’t be able to catch it that close, but if you can you’re golden. (You trade seeing more of a movement for taking on less risk.)

6. Managing the Trade

Let’s say we get long Soy Beans. We’ve got our stop-loss right under the previous low.

Version #1: The market moves against us and takes out our stop (this means the stop-loss is hit and we are taken out of the trade, we are “flat”). This is the most common scenario.

Version #2: This is the more interesting version–the market moves in our favor! Yeehaw! We’re not out of the woods yet though.

Obviously we would love the market to take off in the direction of our trade and lead us to our fortune. If this happens then count your blessings and remember the feeling–because it won’t come often.

Even when we get a winning trade, we have to work with it. It will go up a while and then back down, then up and then down.

When we talk about “managing a trade” we are really talking about three things:

1. Adding to the position. We talked about this a little earlier. Essentially you can add to a position that’s working to double down. Say you get a strong movement in your favor, then it pulls back a bit to consolidate, you can add to your position to double-down on the move.

**2. Adjusting our stop-loss. This is the one you will use most often (as in every winning trade). I like to move my stop-loss to my entry price as soon as possible. This means that if that market moves against you then you still don’t lose any money. I will normally wait until there is a new solid level of “support” created and then move the stop loss up to this new level. A support level is a price at which there is resistance to the market moving below. This is usually created by a small pullback. Continue to adjust your stop losses as the market moves in your favor.

3. Reducing our position (taking money off the table). I alternated between taking 50% of my trade off the table when I had 100% and never reducing a trade unless I got out completely. Often taking 50% or 30% at a certain point is a good way to lock in trades, the only problem is that it limits your upsides.

4. Exiting. At certain reversal patterns I would exit a trade and not wait for it to hit a stop-loss.

That’s It!

Scary simple, right? (There are a few minor things omitted just for the sake of simplicity… these items decided most of the decisions.)

Easy? Hell no.

You probably noticed that I didn’t give you any examples of perfect patterns (if you go back and look at a more magnified version of the lumber one you’ll see a perfect setup). That’s because it takes a massive amount of work to find a great trade. I may have to look through 200 more charts before finding a decent setup.

What Now?

If you’re really interested in this, go to BarCharts.com (or download a trading platform, I like thinkTDA) and look through every single commodity futures chart you can find. Look at a 5 year chart, then if one looks promising look at a 1 year chart, then a 6 month.

- Keep a list of ones that look promising that you need to keep an eye on. Review these every day.

- Once a week review ALL the commodities again.

- When you find a good trade, make it on paper. Either literally with paper or with your program (again thinkTDA is awesome… I don’t even have an affiliate link for them, they’re not sponsoring this post… but now I kind of think they should :P).

- When you start to get good at it, dip a toe in with real money.

That’s 4 steps and a ton of time.

I was going to recommend more books for you to read but I’m not. If you want them in the comments I’ll offer some up but the important thing is for you to actually apply this knowledge first. Go and spend an hour looking at charts right now.

Questions?

This post ended up being fairly long… but the topic is huge. I glossed over a lot of technical stuff on purpose. The goal here was to give you an idea of what it is to be a trader and an example of a method to begin using.

I’m happy to answer any questions you’ve got! Just put them in the comments below or email me.

Hi Kyle! I know nothing about trading, but enjoyed reading this so much. Very entertaining article, Kyle! You’re a natural writer! <3

This was a great read lol 11 at night after closing trades before the weekend. You know it’s funny how people believe they can just put money down click buy or sell and make it big.

Or the bullshit I hear often is what goes up must come down…

I trade full time and I spend many hours doing analysis actually taking the trade is easy…One has to be committed and like you said you have to be drawn to this. I mainly trade currencies and at most I can 1870 pips but you have to have optimal markets conditions the proper patterns etc and even with all that you’re never guaranteed a good week at all the week after that I did 521 pips, Haha, But being consistent is key. One thing newbies struggle with is this fact that trading ain’t no spring it’s a long-ass marathon.

Hello! Love the post. However, I do have some questions if that is OK. Here goes:

First of, do you belive CMC Markets is legit? Or are they manipulating their market so i will lose money?

Here are some other questions i thought of:

– How can the tradingsystem be applied more widely? (What sort of modifications?) Does it work with index and forex, maybe stocks?

– Only future contracts or cash aswell?

– How many years is a OK multi year low, for instance gold. Its at the highest its been since april.2013. But it was at a higher price between april.2011 until april.2013?

– What kind of reversal patters do you use to exit a trade?

– How does it look when the producers make a significant move in the direction of our potential trade?

– What thing were omitted for the sake of simplicity?

– What other books were you planing on recomanding?

Thank you very much!

Best regards, Oskar Tobiassen

god, the accuracy in the article is insane, great job! day trading is by far the hardest thing ive ever tried to do. luckily i was also young when i started so i didnt have a whole lot to lose outside of the money in my trading account

Dude! U described me! That’s me right now. I’ve been trading for about a yr. I do love trading

trading on your own with your own capital is one of the hardest things I’ve ever done….and still doing (not sure for how much longer). I traded commodities for a big company with a very attractive bonus plan. I was making 400-600k/year for 4-5 years in a row plus capital appreciation in the company stock I owned. by 30 yrs old I had well over 1mn in cash, house paid off, zero debt. decided to quite my job and start day trading. 2.5 years into day trading has been the biggest mistake of my career. it’s been a shit ton of trial and error and I feel like I continue to make progress but after almost 3 years and can’t make a goddamn 150k to me is a failure.!! maybe i’m just an idiot but day trading equity markets is fucking tough!!! i’m still going thought b/c for some reason I feel like I can make this happen. but to newbies out there….be careful.;…and if you do plan and trying day trading for a living i’d suggest to have AT LEAST 2 years of living expenses saved up…..it’s gonna take time for you to figure it out.!

Thank you for taking the time to write this. Your post was very helpful. Keep up the good work, the internet needs more people like you. May your tribe increase and your children be blessed! 🙂

i using a strategy called “hedgestrategy1” still works good after 2 month. i can make from 2 to 25 max% per month. i don’t like the indicators, i prefer the hedging.

can you send a link to hedgestrategy1?

Thanks,

I am too old to get into day trading, it’s just a pipe dream for me. The conversations you had with yourself were funny and alarmingly familiar. This article was really interesting, thanks!

And in the comments I have learned so much about wealth recovery 😉

Your never too old to start trading tony. Also I would recommend swing trading over day trading. Just week to week. Every Sunday look at the charts on Sunday. Pre place an order or two and set it and forget it. Come back next week to see if you won or lost. Limit your risk to reward to 3:1 and risk losing no more than 1% of your total account size.

I agree with this article as i have being a victim of these fake brokers. I invested about $590K MAGNUM option and all could do in my first withdrawal was $59k. Then my money started going down the drain till i was left with only the bonus they said i couldn’t withdraw until i fund my account again. The trend continued and i lost everything.Not one dollar was left. I almost died knowing i was scammed. I was very determined to get my money back so i had to hire a wealth recovery expert (adler.frank50 AT Gmail com) who recovered 80% of my money including my bonuses to me. The moral of this story is for everyone to be very vigilant about the kind of broker you invest with and if you have lost some money don’t give up the quest to get your money back.

there is no way to recover 590k!! Most scammers are in offshore so you have no way to get it back!!

Hi Kyle – good read. Found myself wondering if knowing what you know now, you could go back to being that 15 year kid making $5,000 during class, what would you do differently (if anything)?

Aside from get long $SPX, $AAPL, $AMZN etc! 🙂

I’m one of those newbie traders, I made and lost 200k in 6 months, my biggest mistakes were over trading and not putting a stop loss i.e not following my rules…excellent article imo…trading is definitely a psychological game you must master your emotions!

Hi Kyle,

Your narrative is right on! No more daytrading for me, I just don’t have the discipline to handle the psychological side and absorb losses and fight another day. Too nerve-wracking for me!

Thanks!

holy crap now I see why the guys from forexfastlane.com recommended every new trader to read this post. It’s seriously refreshing to see ACTUAL INSIGHTS that are completely objective, just trying to share the info.

I can’t wait until I know what I’m doing! Following their trading fundamentals right now and then I’ll be paper trading… and then.. profit????

Just curious how is the paper trading coming along? I’m going to use the recommended TD Ameritrade. Is that the one you are using?

I day trade 2 chart patterns, Macd bullish and bearish divergences. I only trade one contract and never add to my positions. I make around $80,000 dollars a year. Nice sideline income. I’m totally convinced that trading is 90% mental and only 10% in how one picks trades. Trade small to keep emotions under control and get out of losing trades fast!

Tom,

That is good, Could you share how much you risk per trade and are you focusing on currencies or commodities?

If so which one?

Or just whenever your Macd crosses?

Thanks

Sam

Commodities and some forex. I just get in when the MACD lines cross. As far as risk per trade i don’t use a fixed dollar amount. I place my stops based on the chart, the last swing low if long and the last swing high if short. I trade gold, silver, platinum, tbonds, crude oil, s&p emini, us dollar, Canadian dollar, the pound. Check out “trading forex with divergence” by jim brown on amazon, his books are only 10 bucks and he gives the trading systems he uses. He also has good videos on utube. Highly recommended!

Day trading is like anything else, you need to learn and understand your craft very well. 10,000 hours are needed to be efficient in your craft. For anyone that is interested in trading look into the Wyckoff Method. It works in all time frames from day trading to long term investing. I have been using this method for a long time and make money every day. Look into these educators The Stockmarket Institute, David Weis, Gavin Holmes or Gary Dayton. There are a few others but these are the best in the Wyckoff Method.

All the best to everyone!!

Pro Trader

Very comprehensive and useful write-up. Thanks

Very helpful thank you.

This month, I have made over $43,000 trading forex/crpto currency investment with Mr Tyree Ford amazing strategy while trading, I know as a trader you are wondering how possible this is. Well, contact him as well to enjoy this amazing opportunity: tyreeford005 @ g m a i l . c o m

can i apply the same method on currency trading?…and which time charts is more suitable for this methods….

Do you think those techniques could be adapted to cryptocurrencies or that crypto is too volatile? Most coins don’t have multiyear charts because they haven’t been here for that long. What is your stance on that matter?

Hi Mike, I do trade crypto with similar method. I tend to trade BTC and the inverse for MACD cross, and keep an eye on RSI and other factors. Tradingview provides charts for free for crypto for all time periods I believe. Great community on there as well.

with the help of a recovery expert i was able to recover my money from IQoptions.

I recently recovered my initial investment from a scam broker. I had to resort to unconventional means to make this happen. I am open to share my experience. Feel free to reach out

i suffered so much from this and lost over 200k so far and still now learning on my own and have not made a penny back rather i still lose

i feel it si door close to even regain what i have lost and i have 4 kids and old is becoming my middle name any suggestion

Very solid article!

I use the COT reports quite often, and it is a helpful tool.

Sadly, not a lot of traders take it seriously. It is understandable, not a lot of traders are long-term speculators; everybody loves to day-trade, and for them it is useless. Again, Kudos on the article.

yes

What about algos administered by the market maker of your broker’s affiliate company that trade against your trades. No mention of that here or how to avoid them. Probably because there is not and that is why none of you ended up making money in the end.

That is why trading on the CME is much better than Forex platforms, those guys are definitely crooks.

Hello, great honest article, and your absolutely correct about putting the time in. I’m thankful to be single with no kids. I had to disconnect my phone and stay off of social media just so I can put 8 to 10 hours a day studying..I wanted to ask you if you ever applied a similar method for Forex Trading? Thank You

Hi thanks for a well thought trading rules to go by! I’ve been trading stocks and now more into options and have doubled my money in 4 months. Like you said, having a set of rules are important and sticking to them until the end. It is harder to do because we’re emotionally driven all the time. Keep the fire going. Thanks for your time!

YLAN, are you day trading options or intermediate swing or longer term options or hedging them?

Good, solid advice. I’ve been trading oil futures for several years and your post is spot on. Very helpful. Thanks for taking the time. Sticking to a basic plan that works and not getting emotional is a must. Irrational exuberance over “wins” or depression over losses will only lose you money.

I’ve had a rough go. I’d love to learn how to trade. Read your article…alot of good information. I wished I could just give you my money and close my eyes and hope you make some kind of magic when my eyes open.

Hi l am john collinus nice to meet you I hope this message will not bother you i will like to tell you about the network company bank I work for the network company will help to make an eazy transfer of money on line to company business office family friend and differed country in the world all so will help to save money in hour network company money deposit savings account for secret save and for purpose use this business have be going on for long time now an will have help so much people from differed country and day are happy about it are you in interested to make an eazy payment by transfer money on line or you want to save money in hour network company money deposit savings account for secret save and for purpose use if you are interested to no more about this business you can create on face-book money-line twitter by john collinus or send a message to this email johncollinus1@gmail.com nice meeting you,,.

Kye do you know any broker that can give you startup funds for trading if you want to start but no funding please

Talking of good strategies , I believe its no longer news that Mr Bailey’s has the best strategy today, with more than 200 students making $10,000+ weekly . My life has never been better . This is my 3rd week and you have no idea how rich I am and how my wife and kids are all happy right now. kindly contact him for help for real men who loves doing business via baileyaart1199 at google mail

You’re selling something – would like to see it disclosed.

Good info. Thanks for all the warnings about pitfalls of Forex.

I genuinely enjoy looking at on this site, it contains good articles. “And all the winds go sighing, For sweet things dying.” by Christina Georgina Rossetti.

I have 5million US dollars that I would want to put into a lucrative

business or invest it with a profitable company and share the profits

with the Entrepreneur. If you are interested, contact me via gracejohnson5000@gmail.com

As expected, nothing but a sales pitch.

How is it a sales pitch? What is he selling? Lol

I don’t consider myself a Day Trader, perhaps I may say that I am an Automated Trader, because I use an EA or Robot to Find opportunities and Trade it for me. But being Fully Automated doesn’t mean high profitability or assurance that all Trades are profitable because as we know the Market is a Beast and very unpredictable. I’ve been trading for a year now and in the beginning I am losing money as I am still trying myself real hard if Trading is for me. I prefer the FOREX market because it is moving 24 Hours 5 Days a week and I don’t have to burn a lot of time just to analyze price actions. Although Full Automation works for me, I still don’t recommend it because if it worked for me, it might not work for other people. For the last 4 months since December 2016, I have earned everything I spent when I started trading, and looking forward that I will have more profitable Trades over my losses. Because even if the Robot does all the effort for me, I am still there to monitor how the Robot works and I am ready to switch it OFF if necessary to cut my losses. Robots don’t have emotions and doesn’t care about your Equity, it will just Trade as it was being programmed to do. As of this moment, I am not wealthy yet but I do believe there is a potential for me to become one soon. That is why I continue to Trade and Learn how to manage automated trading until I will sum up all the best procedure to make the right Trading Formula that makes me even more profitable. Even if I am using Robots to Trade, I could still say that I am a Full Time Trader because I don’t work anymore. Forex Trading is now my business and this is where I get my earnings to support my family.

What robots do you use?

how do i email you and how do i find a bullet proof system?

you dont

i am an African i spent $9400 trading , though made profit but i could not withdraw because of bonus policy

then i employed a friend to help me from Spain to withdraw my money he did but only sent me half of all my deposit

it was a hacking means , please is there any help so i can get back the remaining money from the hacker who sent me half and and took the other part , i have his email ( mt4tptraders@gmail.com ) though i was able to get part of my money

Interesting post Kyle! I love how you can describe it , definitly a good read and worth consideration.

you’re an idiot. they make money when you lose money

Well, help? Should I get out or stay in. Losing without stops on the Italy 40 that I shorted, only to have to top up twice with monies because of leverage.

Now the instrument has gone right up and I’m still in waiting for it to come down. Oops! Real money is not much fun. Hubby would go mad?

What shoul I do? It’s only £500 after all

Just learn to b disciplined n take ur losses quickly rather than waiting to go in ur side, it seems u trade emotionally.. Take ur time to get a grip in the market before jumping in straight away.

I am a day trader and could really relate to this column, so much so that i have signed up for the webinar, as i am sure i will learn something new. I agree strongly with the following points a) if you can’t make money with a dummy account there is no point trading for real b) Trading with real money is not the same as trading with demo money, the whole dynamic changes. c) You should start small and build up d) You have to be able to take the hits. Last week i lost 7 bets on the spin, the week before i could do no wrong. e) It is incredibly hard to stick to a system.

This is a contact sport, we all like landing a big punch, but can you take one right on the end of the button?

Great read. I started to trade a couple of weeks ago, on a simulator. I had started investing about one year ago, but it just wasn’t getting me where I wanted. I trade only using supply and demand price action.

and also I recommend everyone to read “a beginner’s guide to trading online“ ,novice or experienced trader

Im 14 yrs old so I have lots of time to study the patterns,day trading and the stock market in genera.wish me luck peeps!(good luck to everyone as well.) Kyle is Chill.

During your trading what broker would you recommend to trust.??

Any feedback is greatly appreciated

Michael

when was this blog/ post posted?

Interesting read. I do agree. I am interested in how you set up your fund? Much like your comment on systematic approach I avoid all emotion when it comes to trading. You have you system and follow a process like any business would. I would note that there is extreme power in compounding which everyone should be take advantage of. It’s a marathon not a sprint.

If you buy a commodity share at 40 dollars a share and it goes below 40 dollars what exactly does that mean? You lost everything and you buy the difference to stay in? I am just lost on how it works.

kyle,

very honest article! to me it seems that this whole daytrading game is a big risk, but having a strategy to mitigate this risk is more important than making money. I think if someone with proper preparation executes 10 trades per day with appropriate stop losses, even if they were wrong on 4-6 trades, their losses will be minimal and if the other winning trades went their way, they will make money!

I personally have had more luck with position trading. Any comments on that?

Fantastic article,Kyle,Thanks 🙂

Great article Kyle! I am excited to apply this and really gain a solid understanding. Mostly been trading options so hopefully these points can also be a good application to that. Maybe ETF options? Looking forward to any new stuff you put out. All the best!

Hey… What resources did you use to learn about this. I would really like to know. Great article by the way!

Everything! I linked to some of them in the article, but there were a ton.

Maybe this is the best place to start: http://stockcharts.com/school/

I’ve had some past experience as a trader. The most valuable information you can have at your disposal is the COT report. I’ve read several books on trading, and I have the book you recommended in the post. You hit the nail on the head. I think it’s amazing that somebody would write this information without charging serious money. I’ve been victim of $40 webinars that were absolute junk. Good job sir!

Glad you enjoyed it Kevin! I’m a big fan of books 🙂

Wow, you are so smart Kyle!!

If I was only half as smart as you, I’d be so happy…

Cool article. I’m getting back in the game but I’m leaning more towards spot FX with a decent ECN broker.

I’ve been working on a scalping strategy that has been running well the last few months in a demo account.

I’ve worked hard to get the emotional side of things out of the way and I feel that is best done via good money management. I feel that your friends 2m account blew up due more ot mismanagement and greed than anything else.

I appreciate your no nonsense approach and it reiterates the need for solid mechanical trading rules. I’m only going to trade two different entry setups based on my system, with a set T/P and SL so that greed and fear will not rule the day.

After some time trading, whether you’re successful or not, the next step is to read this article. Seriously, that’s what I will advise my trading comrades. Or whoever I came across. Reading your article is similar to reading Alexander Elder’s book. It begs to rewire my system and myself. Thank you, Kyle!

That’s high praise, Nolan. Thanks!

And Godspeed 🙂

Hi kyle. Luck brought me here. Awesome, enlightening article. I’ve been trading spot markets but Never had a good record. This article could help.

I just need to know your opinion on this, How much leverage is too much?

That is a very personal thing. I would measure it more by what you’re willing to risk per trade than how much leverage is too much.

Hi kyle. I just need to know your opinion on this, How much leverage is too much?

I’m an options trader that started out with a small account 2 months ago, sticking with strategies that are best suited for weekly and monthly options (no LEAPs). What is working for me is not committing any more than 10% of my available cash to any one single trade at a time. I’m not getting super rich (I’m making an average of $500/mo profit), but I am succeeding at managing risk. And that’s the most important part.

What do you call a trader with a $500 account, who likes to bet the farm ?

Excellent article. As I am starting trading with futures I am still scratching my head any time I hold a contract that is about to expire.

As liquidity normally demands that you hold the front-running contract in most markets I was wondering if I could find any article regarding what to consider when you need to roll future contracts. (i.e. when to do it and what risks are involved).

(I am looking at all markets, i.e. commodities, indices and currencies)

Many thanks!

Hi Kyle !! Thank you for the great post. Just wondering what are your views about those forex softwares available on the internet like Joseph Nemeth’s

(www.4x-dat.com)

Hi Kyle,

thanks for all of this….

But I just dont understand No. 2….

“Keep in mind we want these patterns at a multiyear high or low.”

ok..

“Preferably with a gap.”

That I dont get….how can you have several patterns on a multi year high or low? Isnt the “high” or “low” one moment in time? How could you have more than one pattern at one time?

(I hope this question doesnt make you think I’m a total idiot….but sorry, I dont get it…)

“That means, for the corn chart above, we would want the price to open below where it’s current.”

Why? And to do what? To buy short positions on corn?

Never felt that stupid…..sorry…..but I had to ask…

Awesome!!!

Thank you Kyle for this great blog post! It’s funny how as I read about what NOT to do…that’s exactly how I started my trading journey, by doing all the wrong things and lost money doing it Haha! It’s been just over a year and now I am starting to have consistent profits(with losses in there also. About 60% success rate). Working on discipline, cutting losses short, trading the naked chart so i don’t succumb to analysis paralysis, and trying to stay out of the market as much as possible, until a high probable setup appears. Thank you again and keep up the great inspiring work!

Great post! I sent an email to you Kyle as well! Would like to talk more and network. I own a successful ad agency and have since I was 27 – I am 33 now. I live in Tampa, too! I have always been interested in trading but never took the time to truly learn the business. If you would oblige me, let us chat some! You have my email I just submitted and I emailed my phone number as part of that, too.

Hey Kyle,

Thanks for sharing your story, insights, and method. I love reading articles that reinforce positive trading habits. Keeps me honest and builds those effective neural pathways. 🙂

I am mostly a stock trader. Have you or anyone you know applied this technique to stocks and, if so, how did it fare?

Also, I am deeply into meditation and personal development. I even keep a blog devoted to my twin interests in trading and meditation. I call it No Trader. If you are interested, you can find it here: http://www.jakeyeager.com

Thanks again Kyle!

Take care,

Jake

Jake,

I just checked your site out, awesome stuff!

The technique isn’t quite as effective for stocks because there isn’t an equivalent of the COT reports for them.

Just skimmed your site, it’s cool to see you doing so much right. If you end up experimenting with the stuff here let me know how it goes.

Godspeed 🙂

This was an awesome read, I inspire to be like you.

Kyle, excellent post! When you friend lost much of the $2M, did he fail to set stop losses or what would you/he attribute to the loss? Thanks much!

Bad stop losses, hyper-leveraged, overconfident

Great article, Kyle! I have been paper trading for a few weeks. Thought all was going well so I dipped in this morning. I’ve been using the, pre-market outbreak on great news. Check it > ISR

The price jumped to $2.17 at open. I paused and was watching on level 2. I ended up getting in at $2.00. The stock was bouncing around from $2.10 to $1.95. I decided to put a stop loss in at $1.92. I had to walk away because of my nerves. BAM! Came back about 15 minutes later and my position was sold at $1.92. 1st trade = very disappointing. Later in the day I was traveling so I decided to check and see what the price was now (hoping it was much lower so I would feel like I made a great decision) it is $3.05. I look far into the distance and all I could say was S.O.B!

I sure wished now that I would have known then: put in your stop loss at the previous days low!

Adding this technique to my trading! (please work!)

No need to pray, just test! 🙂

That’s brutal though. Let me know how it works for you!

Hey Kyle,

Thank you for the article! It was great! 1 question for you:

I find myself second guessing myself when something goes wrong, so I set up stop losses and it seems like 99% of the time It stops me out then goes right up from there lol. Any advise on setting up a good stop loss? Like is there a range that I should be setting up instead of just setting up what I don’t want to lose?

Thanks!

If that’s happening regularly (and doesn’t just *feel* like it is) then you probably want to find new way to set your stops. Just being “looser” won’t be helpful though. And setting it up just for a 1% loss (or whatever you’re willing to risk) isn’t great either.

This is going to vary on your time-frame and risk tolerance, and contract you’re trading. Usually I would just put a stop below a previous layer of major support.

Wondering what you think of Harvey Walsh’s “How to Day Trade Stocks for Profit.” I am interested in day trading and look forward to practicing with paper. Thanks for you article.

Max

I have never read or heard anything about Walsh’s book, wish I could be more helpful!

Hi Kyle, this may be stupid question but, when you say;

“The second thing I would look for is a daily Morning Doji Star or Hammer Candlestick.”….

Do you mean you want to see these patterns each day, or you want to see these patterns once on the daily graph?

Great article. Thanks

Just one on the daily graph. Glad you’re actually putting it to use 🙂

Awesome write-up…good job

keep it up and expect tons of questions from me later on hehehe

very informative Thanks 🙂

I’m looking forward to them 🙂

I thoroughly enjoyed your post! Trading can be lucrative and it is very exciting! By following the industry research and opinion and utilizing sound statistical rechnical analysis it is no surprise you have done well! I would like to clarify one salient point regarding Warren Buffet and his thoughts on investing. As a professional investor and one follwing his methods I feel wholey qualified to say that while warren advices the unintelligent investor to invest in index funds he advices the professional investor to arbitrage sure things and purchase great businesses at discounts. Personally I have had success using these methods. I had an excellent surplus to the market last year and expect to beat it again this year. If you really Are good at trading I would suggest reading books by Mary Buffet regarding Warrens methods. Be wary of some of the advice regarding stock choices but the math and methods are sound and approachable. Please feel free to email me to discuss it more

Kyle,

What do you think of trend following and more specifically Michael Covel and his books?

Trend following can work – don’t know enough about Covel to have an opinion unfortunately

What was the average amount of time you’d hold onto a single position?

During the trading I focused on mostly, average was probably 8-10 days if it survived the first day. Most behaved badly immediately and so I got out within hours.

Thanks for the info. I jus started trading and my system works. I traded paper money for 3 weeks then implemented my system with real money and it works! I jus have to have discipline to get out as soon as I hit my quota for today and not be greedy or try to make more. Yea it bothers me sometimes when I see that I could make more but I rather follow my system and be safe cause I make money everyday literally

If you’re making money every day you’re in the top 99% of traders… don’t get greedy!

Congrats!!

I loved ur post and i deeply appreciate…

I don’t know where you were going with that, but I deeply appreciate too 🙂

thanks!

Anyone know of anyone good tutorials to learn the mechanics of thinkorswim?

I’d recommend their internal help stuff, it’s good

I’m a day trader and formerly a market maker of commodity options.

Tough business with a lot of hidden risks (mainly revolving around technology.. for me anyways).

I have enjoyed the consistency and — to use a trading term — high sharpe ratio of returns in importing/selling online. Once the online biz is big enough I’ll be happy to take more risk trading and potentially hire on a FT quant to run my book.

Anyways, cool article. — always looking to chat with solo-traders (dinosaurs) (real traders, not e-traders)

Trading is the hardest way I know to make easy money…

And to those who think their going to learn how to trade in a few months… SEVEN YEARS! before I had any kind of consistency. And I have a 150 IQ. And I’m about as emotional as a goldfish.

Trading is so incredibly simple that people think that equates to easy. So is losing weight: eat less exercise more. Why then can very few people do it? Simple does not equal easy.

Amen

Hi I browsed through charts of dozens of commodities but the COT charts are only available for a handful of them. For example, I couldn’t find the Cot chart for Zinc or Copper. Does it mean you used to trade only 10-12 commodities? If yes, then why browse through 200 odd charts as you mentioned in the post.

COT charts are available here: http://www.cftc.gov/MARKETREPORTS/COMMITMENTSOFTRADERS/INDEX.HTM

I think you’ll find everything you’re looking for there 🙂

You may be looking at a site that only provides COT charts for certain contracts

Awesome post (though I admit, it’s really late here and I’m falling asleep, so have bookmarked to read the second half tomorrow. Lol)!!! I’m studying up on day trading right now. I only have a few grand and was looking into perhaps starting with CFDs. What are your thoughts on them?

Great article Kyle! However, I have one question: you mention that you would pass on the soybean oil trade because producers are still significantly short soybean oil. However, wouldn’t producers of a certain commodity always hedge their risk by entering short futures positions on that commodity? So even if the price of the commodity was in an uptrend, wouldn’t they still maintain a mostly short position through futures contracts and make their profit exclusively off of their actual production. After all, they’re not speculators. Thanks for the help, John

Absolutely the best write-up about trading I’ve ever, ever, ever seen!

Thank you Kyle and thank you StartupBros!

I am tempted to rattle on about my experiences and thoughts: possibly to vent and hopefully to help by emphasizing what you said. But if your readers really read this “manifesto,” they can skip reading 99.999% of anything else written on the subject including anything I would say. ( I may be a few 9s short, so please excuse any lack of precision. The accuracy is still there.)

Sincerely

Thank you for the high praise Robert! I would love to read about your thoughts and experiences if you’re willing to write them.

You’re welcome!

So, per your invitation to share my thoughts and experiences, I’ve re-read your post. YES, it is still the best!

At present, I simply don’t have the oomph or time to do a thorough post of my own. Instead, I’m going to just make a few comments. They will primarily reference your fine post. (By the way, the time thing is partly your fault. Your piece on “Antifragile” has me now poking around in Taleb’s 300+ page “Silent Risk”. Plus, your site has lots of other good stuff.)

Onward.

NUMBER 1: People need to re-read your “What Not To Do.”

There are so many things and ways to trade that whenever people would ask me about trading, I would always start with a few don’ts and shouldn’ts.

My main shouldn’t was: “You probably shouldn’t trade.” It was accompanied with a statement about why. Your version is: “DO NOT: Trade.”

After that, if we were still talking, I tell them some things they would need to be able to trade effectively: margin account, real time data feed (even for chartists), direct execution broker, etc. AND my one hard rule.

The rule is a disguised “don’t lose all your money.”

I would say: “Remember there is always another day if you still have money! Base each specific trade, any type of trade, and any system, method or approach you use around this one rule! Again, base … !”

Of the two things I feel are a “little off” about your post (it is still the best I’ve ever read), not emphasizing “capital preservation” more heavily is the main one.

Of course, one doesn’t make fantastic money, $30,000 into $2,000,000 in 3 months, by even having the word preservation in one’s vocabulary.

One of my best “runs” (after having not traded for over 6 months) was to go from $18,500 to $106,000 in exactly 3 months. Of course, the first month, I turned the $18,500 into just over $13,000. End of story.

But, as you say later in your “What Not To Do” section, “DO NOT: Get Caught Up In Stories.” So, please, please don’t get caught up!

My second point of mild disagreement, is with “DO NOT: Use Real Money Before You Know What The Hell You’re Doing.”

Without some “Skin In The Game”, you don’t Really know what your doing!

Firstly, you are only going through the motions. This practice is important and needs to be done. One needs one’s mechanics down and a plan to execute.

Good mechanics are needed so one can do what one intends and not &@#*^ it up–going short instead of long, buying/selling too little/much, buying/selling the wrong things, etc.

With a plan, one can take a “trip” and then evaluate and correct or adapt.

BUT, I question “how much practice” is needed without any real risk. Live Action changes the dimensionality of the game.

Also, some early light or moderate losses help moderate the impact of stories not ignored, quell mental extrapolations that confuse “might be” with “will be,” or more simply dampen greed.

NUMBER 2: My last trade was early 2007. Got my ass kicked due to a bad data feed.

NUMBER 3: THAT’S ALL (for now) FOLKS !

Best

To me this is a lot like playing poker.

You can be the best player around, but even then you are only going to win about 65 percent of the time.

And if you don’t play within the limits of your bankroll you can go broke easily.

What up Kyle! long time no see, just read your post it was very interesting. do you have any info/tips on more of a long term position?

Yo JD!

I actually do have some ideas for longer positions– send me an email over at kyle at startupbros dot com with some details about what you’re thinking and let’s chat.

Good to hear from you!!!

“Warren Buffett’s #1 rule in investing is to keep your capital. He says that his regrets have mostly been acts of omission instead of commission”

Haha! I JUST watched a video on Youtube (with Buffett & Bill Gates) where he said this verbatim. I am frequently astounded by the synchronicity in your articles and my own life, Kyle!

On a sidenote, I think Buffett and Munger have a ton of useful best practices for personal development.

I do love some synchronicity! It always feels like there’s a group of people following similar threads of ideas/thinking/action… it’s interesting to see the variations in them!

They do have some great personal development ideas out there. I love Munger’s idea that you should leverage your own circle of competance instead of tryingt o compete outside of it.

Great article Kyle, I believe lots of traders will benefit from the truths you have shared. I am also monitoring Commitments of Traders data, and advise everybody to do the same. This is not another fancy indicator that derives itself from price data, but comes from an entirely different source, and lets you peek inside the structure of the market. Here are some more stuff on COT analysis if you are interested: http://cotbase.com/resources/books

By the way the first book I read on COT analysis was the same you recommend, from Larry Williams (excellent stuff)! Another great work is from Steve Briese.

Note: I am the co-owner of the above site, http://www.cotbase.com, that we created from our Excel tables that monitored the changes in COT data. Once the tables became so big that Excel could barely handle them, we asked a programmer to build an app from it and also open it for everybody on a subscription basis.

Hey Balint–great to have you swing by! I was HUNGRY for your service when I was trading. It would have been a HUGE time saver!!

How much capital did you start out with and how much would you recommend a newbie start with?

Hey Stephen,

I started with just about $1k – I wasn’t trading full commodity futures contracts until I had about $10k in the account (even then, the risk per trade vs the account was huge), plenty of people start with just a few hundred though. $500 seems to be a good minimum.

This doesn’t mean that you shouldn’t start practicing though! You may spend 6 months paper trading before you find something that you can begin making money with, so if you’re interested, begin studying now regardless of the amount of money you have to play with.

What percentage of the 10k were you risking per trade?

So I stayed between 1-5% risk for most of the time–I increased risk slightly as I became more competent. I actually traded S&P 500 futures before doing commodities in a big way. Once I hit that I increased the risk tolerance of my personal account to 10% per trade (sometimes even more). The trades just worked so often (and were somewhat rare) that I felt alright with this. This was somewhat suggestive. Sometimes a trade was just so perfect-I could get in with a tiny risk for the potential reward or the setup was lined up perfectly-that I had to go bigger. If I did get punished for a big trade then I would pull back my size by a lot.

Also, remember that the 10k was capital I was willing to lose – I would have been happy to seed another 10k to go again.

Kyle,

Awesome post! Not terribly long ago I looked heavily into what avenues of approach their are to successful active retail trading.

I found and quickly ran away from all the newsletters teaching “perfect penny stock plays” and so on (like you warn against)… It felt impossible to actually find anyone trustworthy: “yeah, pump and dumps!” (what??? No thanks LOL)

I eventually found the options trading methodology Tom Sosnoff (who created sink or swim and sold it to TD) teaches at tasty trade … He has a site by that name and a youtube channel. His new platform he’s created is called dough. Dough will show you probability of success, max profit and loss etc on positions before you open them, and it links with your TD account. There are training modules all built in, its all free (except you can pay for access to see all his actual trades I think, but not necessary).

I was going to rehash what I’d learned listening to him but I’d be at risk of losing something in translation, not actually having implemented it myself I don’t feel expert enough, but suffice it to say I think its worth a look if you/anyone gets into options ever. Those with options experience – your thoughts?

Anyway, what turned me off for now was the same trading time for money making me cringe idea… but if I ever get into trading, that’s the methodology I will test (with paper money to start, of course 😉 )

For now, going to keep learning in the importing course! Loving what we’ve gone through so far… Keep up the great work!

Hey Patrick!

Great to see you here. I never looked into Tom Sosnoff–thanks a ton for telling me about him! I’m a big fan of thinkorswim so I will most definitely be checking out his other work.

A couple of people in the comments mentioned options but I haven’t gotten into them myself.

The Importing course is a much more solid base I think–I’m pumped to see what you do with that in the coming months!

I’ll see you in the group 🙂

Hey Kyle,

Awesome, read. I love the no BS approach to telling it like it is. I think it is a fascinating subject with never-ending possibilities and risks. Currently, I am in the import empire class and doing some consulting while working full-time. By reading this article, I realized that if I want to trading, I pretty much have to put all my efforts and energy into this with no other obligations for awhile. So for now, I will leave this as a future project.

Thanks again for sharing your story and look forward to reading more posts. I think what you guys are doing at Startupbros is amazing. The value behind your content is just so much greater than most any other type of entrepreneurial blog/books/content etc. I’ve read Self-Made U 3 times now. I guess all I’m saying is thank you and keep it coming!

Jeff

Hey Jeff,

Thanks a ton for taking the time to comment. It’s great having you in the importing course–it sounds like that’s definitely the best way for you to be spending your time/resources.

That is a HUGE compliment! We try hard to give the best content possible. It’s kind of bizarre selling books. I see them sell on Amazon but I rarely get to interact with people who have read it. So when you tell me that you’ve read it THREE times… well, that makes my freaking day!

Feel free to drop a line any time! See you in the importing group 🙂

Kyle

I’m from the original import empire startup group and really loved this article! This really peaked my interest in the markets again. Back when I was in college I was able to trade some and payed for my college outright! That was one of the best feelings ever!

Maybe I’ll get back into it now. Gotta get to work on importing though….

Great Information !

I’m glad!

Kyle, freaking that was indeed an awesome article. I have long left the trading world because of getting burned by the company not giving my earned money and wasn’t trading faults. Should say be aware of cyprus entities. Anyways the whole article that established the mood and the emotional swing of traders world is what made me write the comment.

Cheers

Deep

Thanks for the comment, Deep. Sorry to hear you got burned

@Deep,

Sorry to hear that you got burned by the forex company. When was that happen? now a days many are financially regulated, and being monitored (as they say, and as we can see)… Who was the broker company? if you like to share that info, that would be very useful for all of us… Thanks

how do I get started ?

Spend an hour right now sorting through charts and see if any fit the requirements I described

Very nice well shared. Thanks a bunch I did learned a few new things..

Mission accomplished 🙂

Interesting…

It is not exactly true 99.9 percent of traders fail. It is actually closer to 80%. There is a lot of break even as well. How do I know???

IRS records!

I am a gambler, who trades basketball. Rich? No. But I have several years of $50 to $2000. I use Betfair out of England.

I say gambler, but really I trade. I have a very simple system. Trading baskets mostly, NBA. It usually works, but last year failed. I moved to the country side of life, and the Interent kept failing as I traded.

In simple terms, it is the life of IBM, all of it, in about 2.5 hours.

I just take 4 point leads, set a winning sell point, and sell if they lose the 4 points. And yes, it can lose 23 times in a row! You can trade anything, I won $300 one night half wasted on Obama to win. Not that I am a democrat, it looked like a good trade! Plus, I was bored. lol!

I do like to read about other traders. Facinates me!!! Thanks!

I take what they know, and see if I can use it.

Seriously, I was going to try import export. But I am too sick to do it. Epileptic. A bad one. My driving could cause Nascar like accidents!

My real goal in the whole sports trading experiment, is to see if one can make a living with it. You are correct. Bullshit abound!

But I did find a few real stories of real people doing it. I only want about 50K a year. I’m happy.

My biggest problem, is not the mental parts. It is the low liquidity, by times, and a max win I can acheive per day. I never add to trades. Fails horribly in baskets.

I built a baseball model, that allows to me trade, easily. No plans to sell it, well not in the way most people would. I just want it built for me, by programmers so I can use it. They can send me commission money if they want, for people who subscribe to the charts. It really is like a stock chart!

So when I see things like you post, I am very interested. Have you ever considered, the angle of decent? Say a 50 day moving average, moving through a 200 hundred day one, at a super fast decline? Like 45% instead of 15% over a certain time frame. I gotta check that out.

And yes, stockcharts.com is a great place to learn!

-Allan. Curious and always learning trader.

P.S. Two things to add. Trading is a loney and anti-social way to live. Those two things, I am almost sure, are the driving forces of failure or success. Be anti-social when you must. Don’t drink when lonely. lol!

FOREX is next for me, but real slow…

Your PS is solid lol– I should have mentioned some of the mental effects of spending 14 hours alone staring at a bunch of screens… it’s brutal.

I’m interested in your basketball “trading”… Will plays with this a bit for fun and does well. (We’ve been playing pop’a’shot like crazy.)

Thanks a ton for sharing your story.

I’ve done a bit with moving averages and other indicators – they’ve done well but I made way more money with other things.

FOREX? Good luck sir! But honestly I think you should consider something a bit cleaner

i’m still waiting for those spreadsheets. remember those xtz teas from the rock and java days?

can you imagine forex from big red?

it’s only english that’s binary.

I’m 28 years old and I never went to high school.

but i did learn one thing…. two cats and a dog = death. two dogs and a cat = death.

“two cats and a dog = death. two dogs and a cat = death.” – that’ really the only thing we need to remember

What does that saying mean? I googled but found nothing. I enjoyed the article by the way, bookmarked it and will re-read it several times when I feel like I’m straying from my mental focus during my trades. Thanks for sharing!

Hey Allan,

I’m not trying to play doctor, but have you ever tried a paleo or ketogenic diet for your epilepsy?

That’s interesting Stephen, I never knew paleo could help with something like that. —Is that a grain brain thing?

I think it might be because the body is using fat as fuel instead of carbs?

https://www.epilepsy.com/learn/treating-seizures-and-epilepsy/dietary-therapies/ketogenic-diet

http://www.google.com/#q=ketogenic+diet+and+epilepsy

http://www.google.com/#q=paleo+diet+and+epilepsy

“Over half of children who go on the diet have at least a 50% reduction in the number of their seizures.”

… damn Alan, sounds like it’s worth a shot!

Thanks a ton Stephen, that was cool of you to share

No problem, hope I didn’t derail the comments too much. 🙂

lol you’ve been too helpful to “derail” anything!

I lost $600 in the Forex, once.

There’s still a side of me that would love to learn this world.

Maybe someday.

Excellent writeup.

Hey Q-Man,

When you get into it again it’d be worth trying to get a solid mentor.

Godspeed sir!