DISCLAIMER: This documents my personal investment strategies, and are for your educational use only. Trading options & investing in general is risky, most people lose all their money, and I don’t want anyone blaming me. I’m just some guy on the internet who dropped out of high-school and doesn’t even have a diploma 😉

Did you know you can choose the exact price you want to buy a stock at, and actually get paid cash until that stock hits your desired price?

For a long time, neither did I! I sat there placing individual stop-limit orders slight above/below the current price, thinking I was getting a great price…

In reality, I was just wasting my time worrying over pennies and cents.

There’s a better way to buy & sell shares of stock — generating consistent income on top of your existing investment strategy…

Quick Rundown on Options

To understand this strategy, you only need to learn about 2 types of options trades — a naked put, and a covered call…

But to understand that — you need to understand options contracts in general…

Options are just contracts that give you the

right to buy/sell an asset (in this case, shares of stock)…

Options that give you the right to buy something are calls, and options that give you the right to sell something are puts…

Every options contract is going to be made up of a few elements:

- Type of Option (Put or Call): Does this contract give someone the right to buy or the right to sell?

- Underlying Asset: What is the actual asset that person has the right to buy or sell?

- Strike Price: What price does that person have the right to buy/sell the underlying asset for?

- Expiration Date: What is the deadline for this option to be exercised?

- Exercised: When someone decides to actually execute the ability to buy/sell the underlying asset.

- Premium: The up-front payment to the other party of the options contract (compensating them for their risk).

If that sounds completely confusing — that’s because it is. Let me give you a more real world example…

Give Me the Option to Buy Your House…

So imagine you and I enter into a contract — giving me the option to purchase your house any time in the next year for $500,000…

This option is worth something, because if the value of your house goes over $500,000 — I could force you to sell it, and keep the profit…

So you wouldn’t just sign that contract for free — but I might be able to pay you $50,000 to sign it…

So our options contract would look like this:

- Type of Option (Put or Call): You would be selling me a call option, giving me the ability to call the asset to me at any time before the expiration date.

- Underlying Asset: Your house.

- Strike Price: $500,000

- Expiration Date: 1-year after opening the contract

- Premium: $50,000

And this example actually shows off one of our strategies perfectly — you’d be writing covered calls, generating $50,000 per year of income by giving people the option to buy your underlying assets…

Still Confused on Options?

This post is simply to show you how to use naked puts & covered calls…

If you’re a new investor who isn’t familiar with how options work, don’t jump into this strategy without fully understanding them.

There’s a ton of great resources out there to learn about options (and they’re all free).

That being said — let’s make this more complex…

Naked Puts & Covered Calls

So how does this all lead back to a better way to buy & sell stocks?

Two quick terms you need to know to understand these strategies:

- Naked: You don’t own the underlying asset

- Covered: You own the underlying asset

Both Naked Puts & Covered Calls refer to writing options contracts — meaning you have no control over whether or not the option is exercised…

But in exchange for giving that other party an option — you’ll collect a cash premium, regardless of anything else…

So to simplify — we’re going to write naked puts to purchase shares, and we’re going to write covered calls to sell them…

Writing Naked Puts

When most people go long on a stock, they’re watching it way too often and trying to time the price buying individual shares for weeks…

This is a huge waste of time, and only encourages you to invest shortsightedly…

The right way to purchase a stock is this:

- Figure out what company you want to invest in: This strategy ONLY works for stocks you actually want to own for the long-term

- Figure out what price you want to buy it at: Forces you to look at financials & comparables (though some are purely speculating)

- Sell Naked Puts at your desired strike price: Get paid a cash premium to NOT buy your stock until it hits your desired price

- Repeat until naked put is exercised: When the price drops below your desired purchase price, you’ll be assigned your shares (usually 100 shares per contract)

And here’s a real world example:

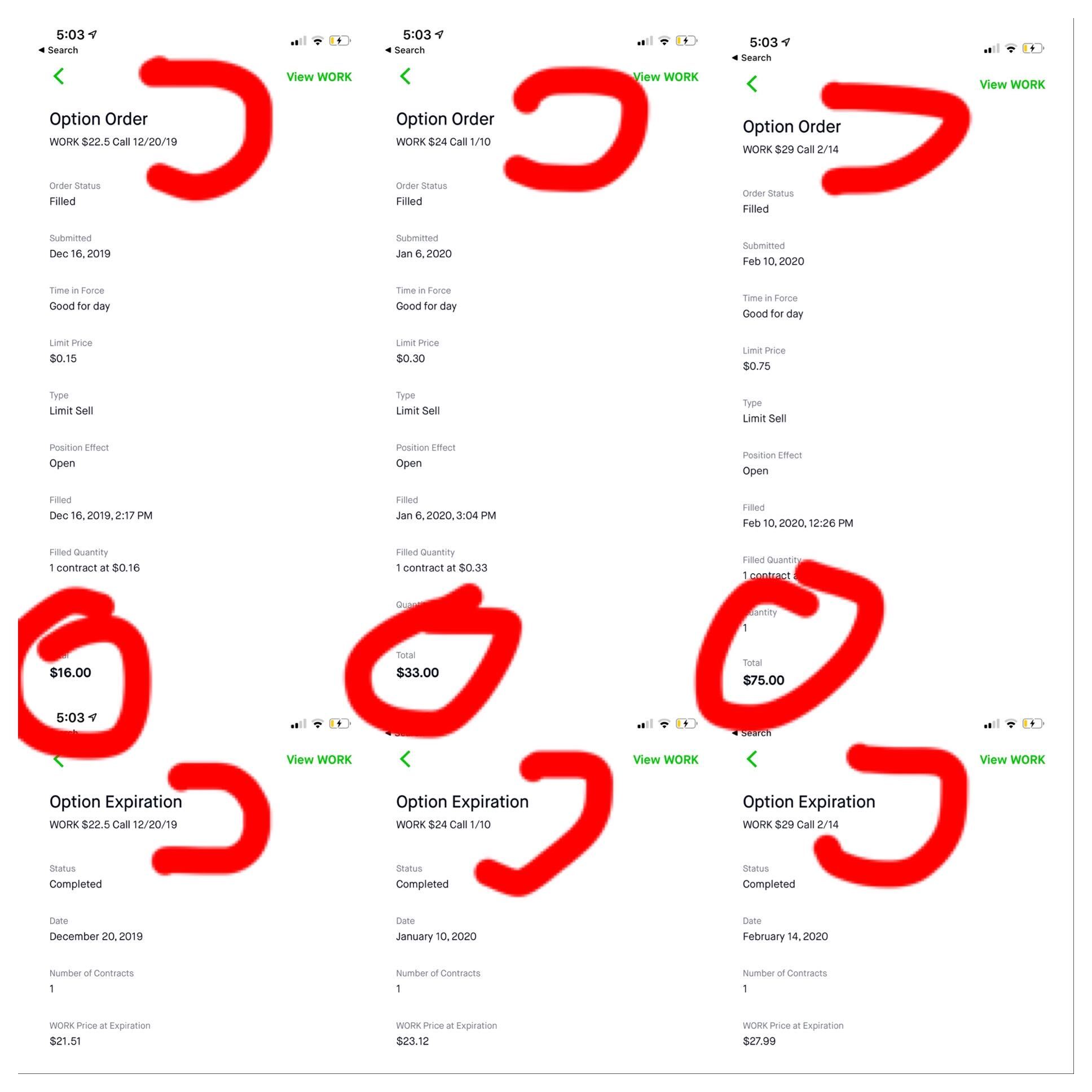

Slack (WORK)

I’ve been a big fan of Slack for a long time, so I was excited to invest in their stock once it went public. But I felt like the price was a little hot just after the IPO, hovering a little over $20…

As much as I love Slack, I didn’t love it much over $20 per share…

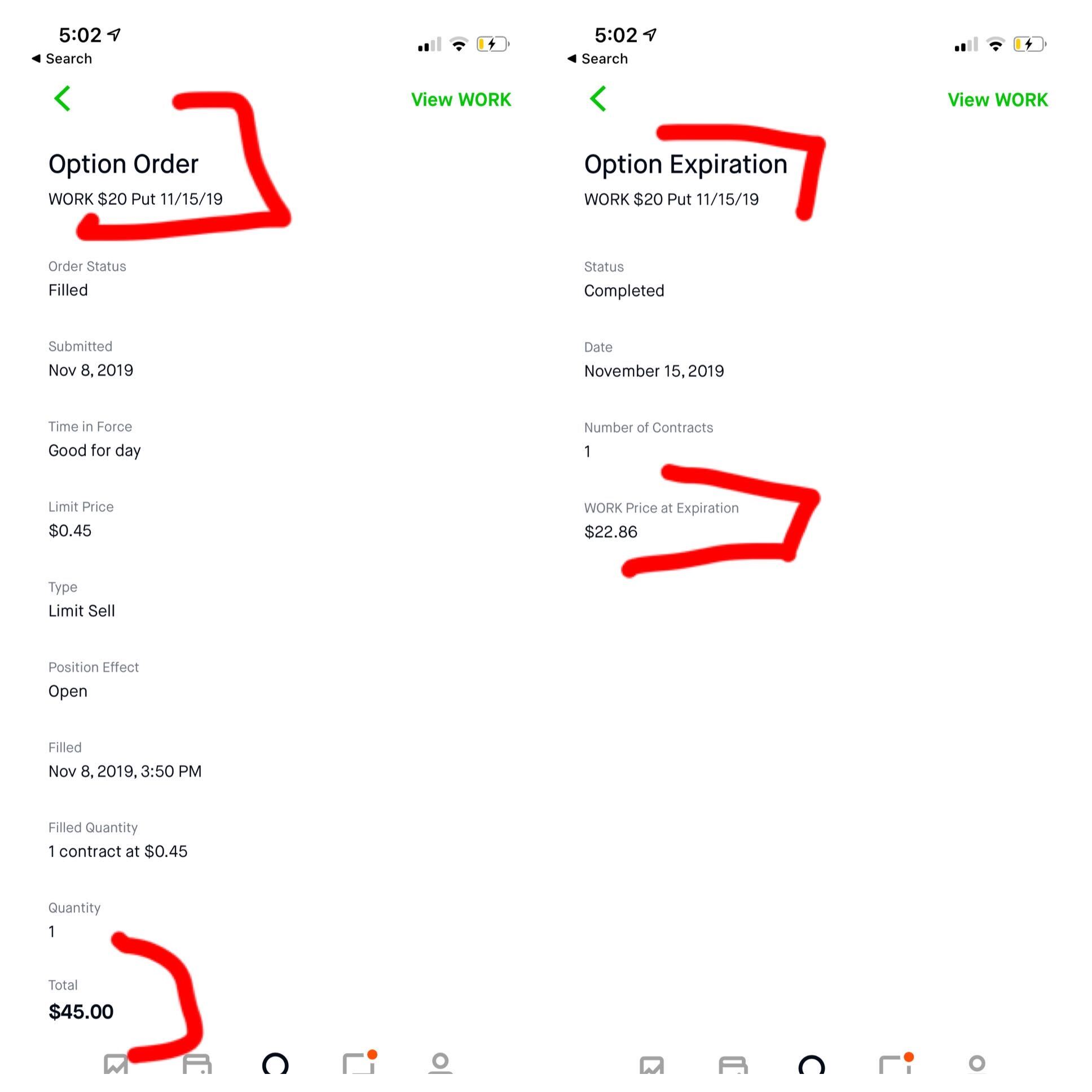

So instead of purchasing the shares outright or waiting for the stock to drop, I started writing Naked Put Options. Meaning I sold a put option, but did not own any stock to collateralize (making it naked)…

As you can see, my first naked put expired on a week after I wrote it. Since Slack’s stock price didn’t fall below my $20 strike price, the contract simply expired worthless — and I got to keep my $45 premium for writing it…

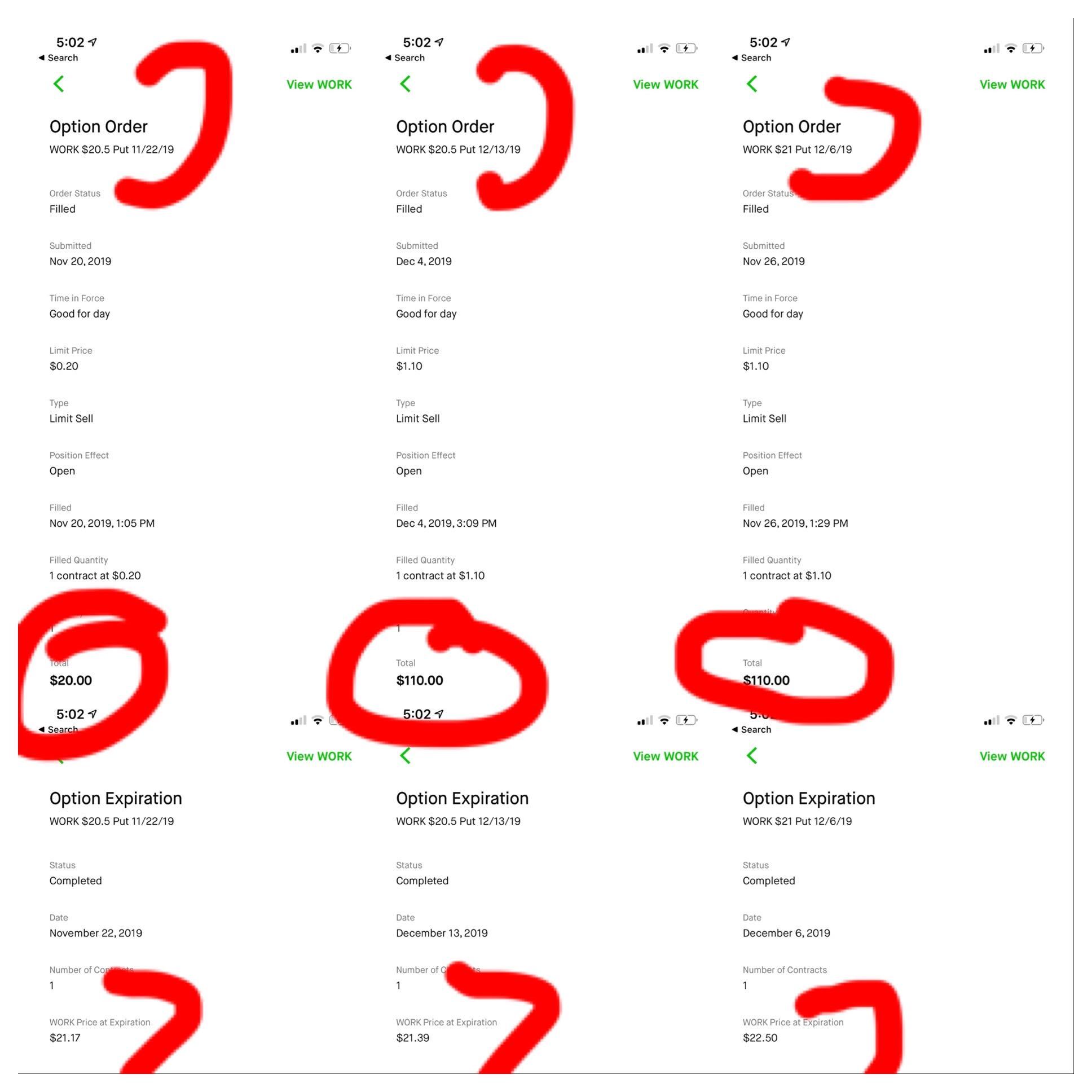

Over the next few weeks, I continued getting paid to NOT own Slack’s stock…

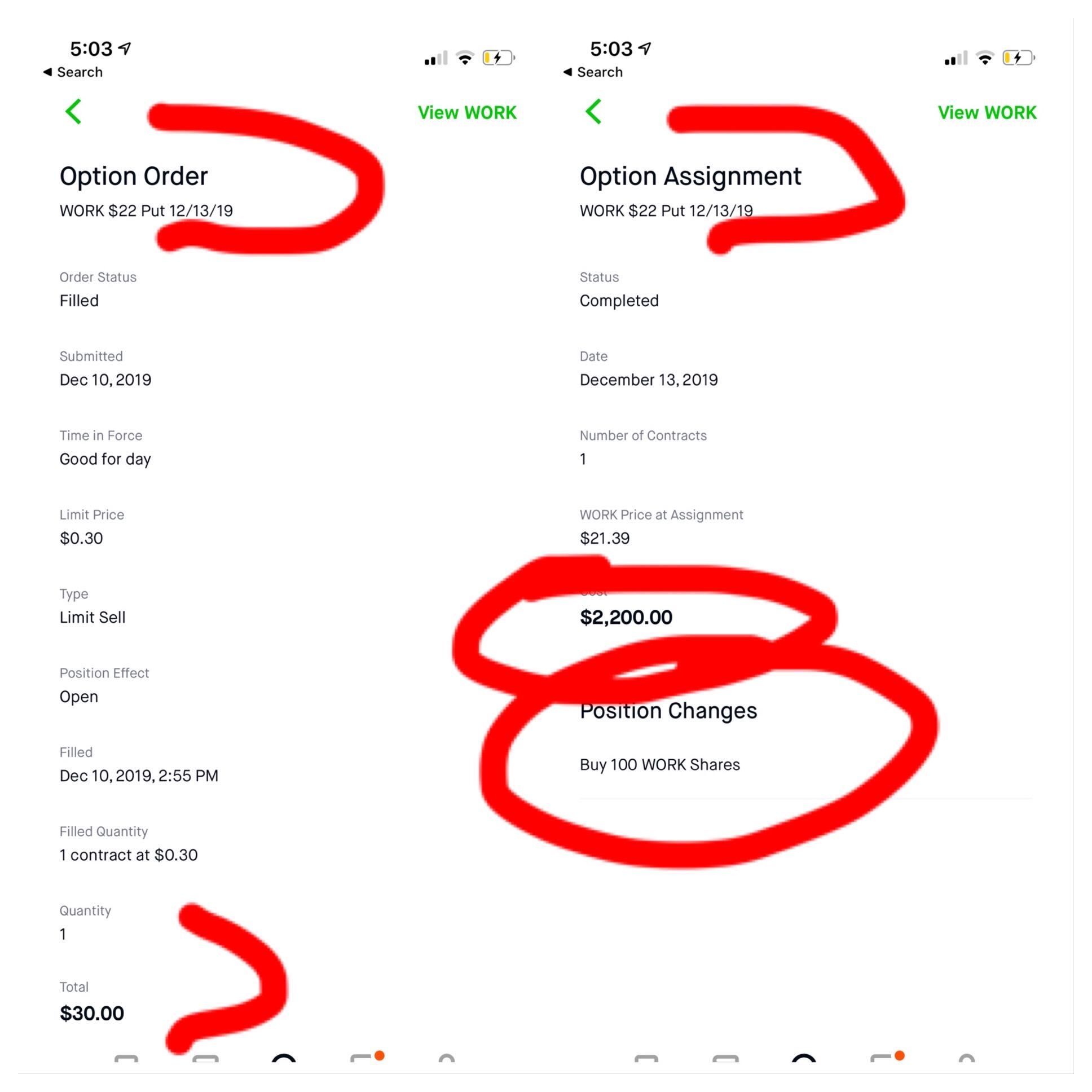

By the time my naked puts were finally assigned (and I actually had to buy my 100 shares of Slack) — I had already been paid nearly $500 in premiums…

I ended up paying $22 per share of Slack — a little higher than my original target price. But I was happy to pay the extra $200 with my premiums, and still had some cash left over…

So this strategy worked perfectly for Slack — but let’s look at an example where I didn’t actually save any money…

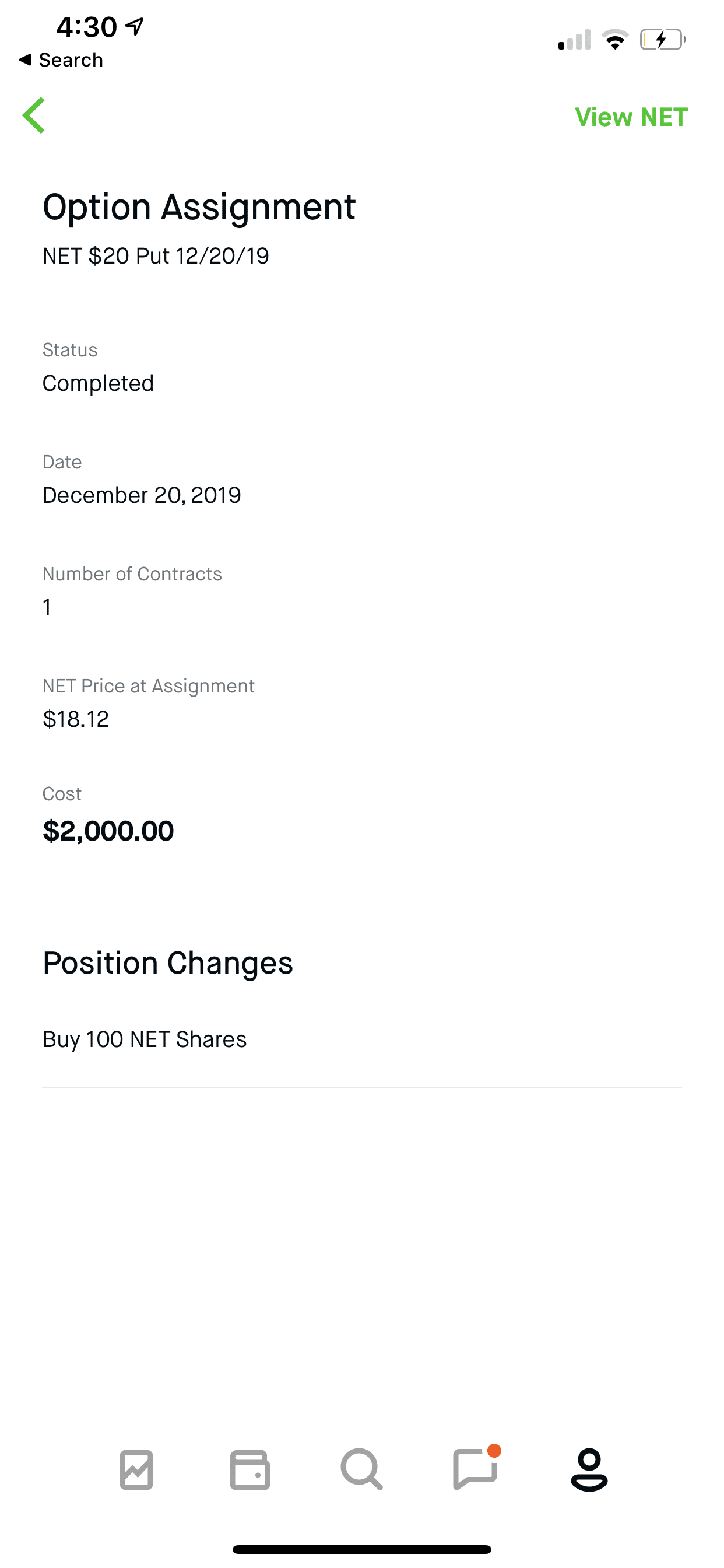

CloudFlare (NET)

I run all my websites through CloudFlare, and felt like it was going to be a strong investment. The stock was floating around just under $20 for a while, and I felt like anything under $20 was a solid buy…

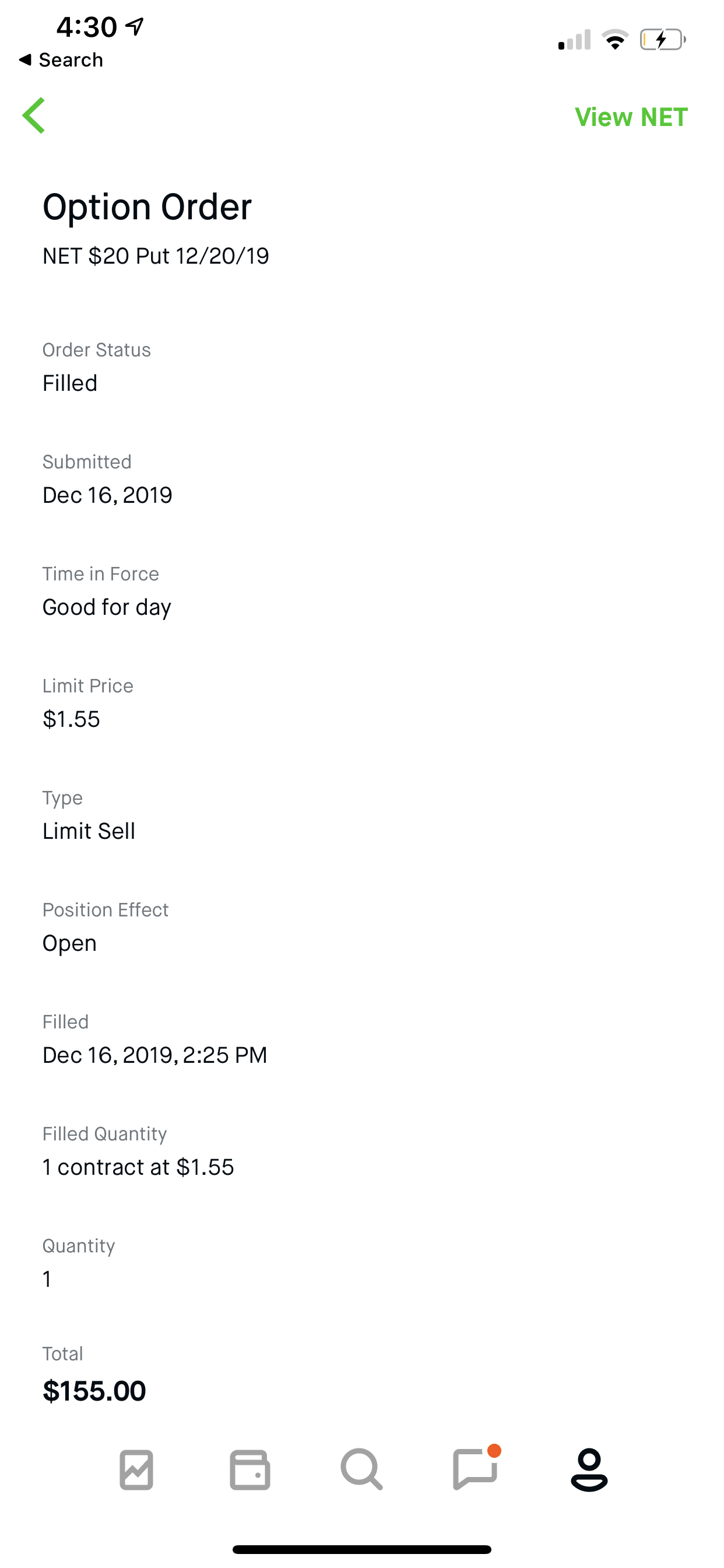

Instead of just purchasing shares for the $18.46 it was trading around that day, I just wrote a Naked Put option…

As you can see, I was instantly credited $155 for writing this naked put. The stock was already under $20, so I was heavily expecting it to be exercised. And it was assigned just before expiration —

I ended up paying $2,000 – $155 = $1,845 for 100 shares of CloudFlare (NET), or $18.45 per share. So I could have actually gotten in lower on the day of expiration.

However, I am still happy to purchase stock with this strategy — even if I sometimes pay a little extra. I promise I made the ~$30 back with the time I saved not trying to time my entry 🙂

Generate Income w/ Covered Calls

All right — so now I’ve got myself 100 shiny new shares of WORK & NET…

For most people, the game stops here. They buy stocks, and then sit there and stare at the price every day…

But you can actually use the 100 shares you just bought as collateral for more options contracts — allowing you to generate income from your portfolio while holding it for long-term appreciation…

Once you have your 100 shares, you simply write a call option — in a strategy called a ‘covered call’…

In the same way you collected a cash premium to write a naked put — you can collect a cash premium giving someone else the option to call your 100 shares to their account…

To give you an example, look at what I did with those 100 shares of WORK after I had them assigned to me:

As the price continues to go up, I continue to sell covered calls to generate income…

If I think the price is going to appreciate quickly, I’ll sell pretty cheap covered calls (that aren’t likely to be assigned). If I think the price is too high, then I’ll sell more expensive covered calls closer to the current price…

If the stock appreciates beyond the strike price of your covered call, then the option will be assigned — and you’ll lose your 100 shares. So be careful not to sell covered calls too close to the current price if you want to keep those shares…

And that brings us to the next move you should know about…

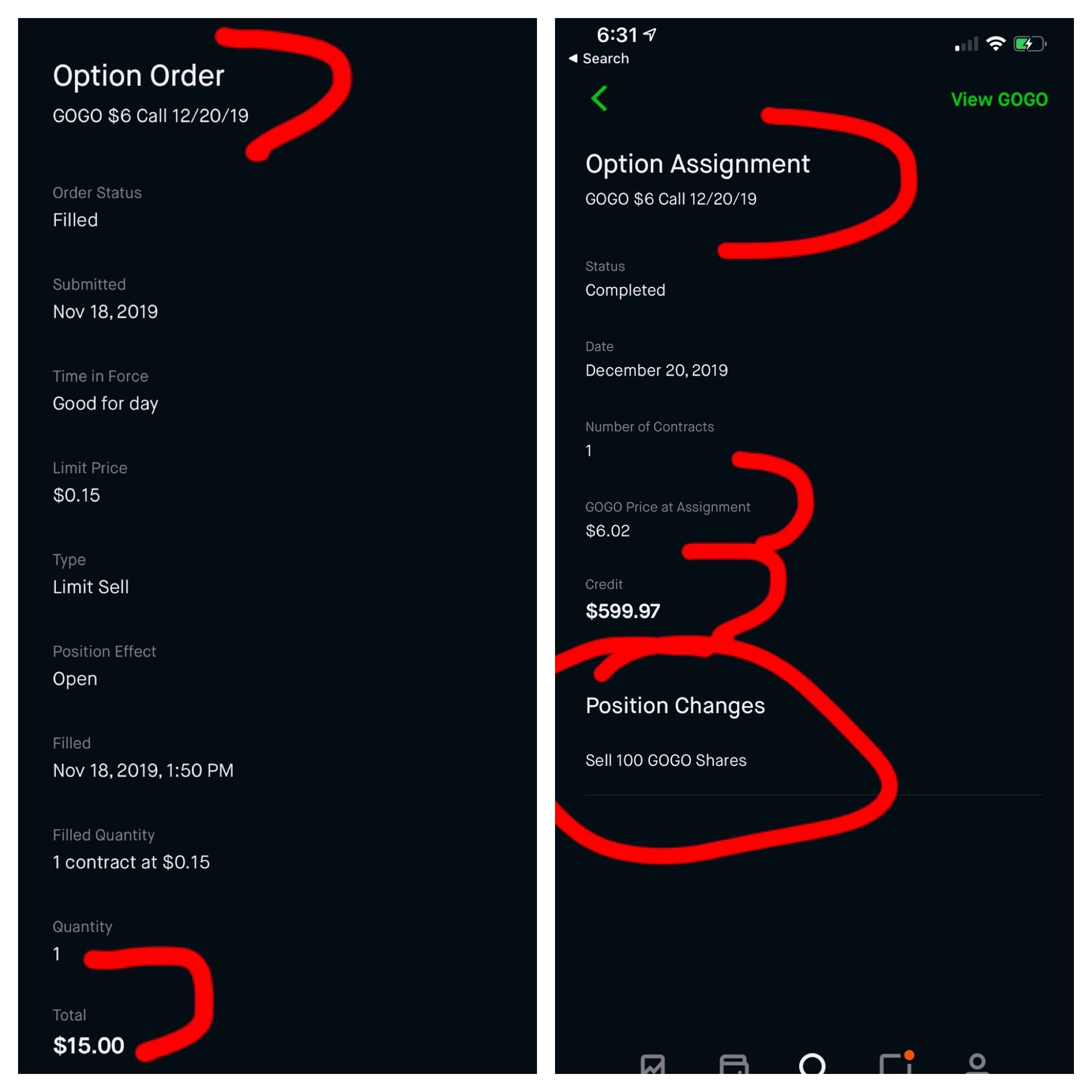

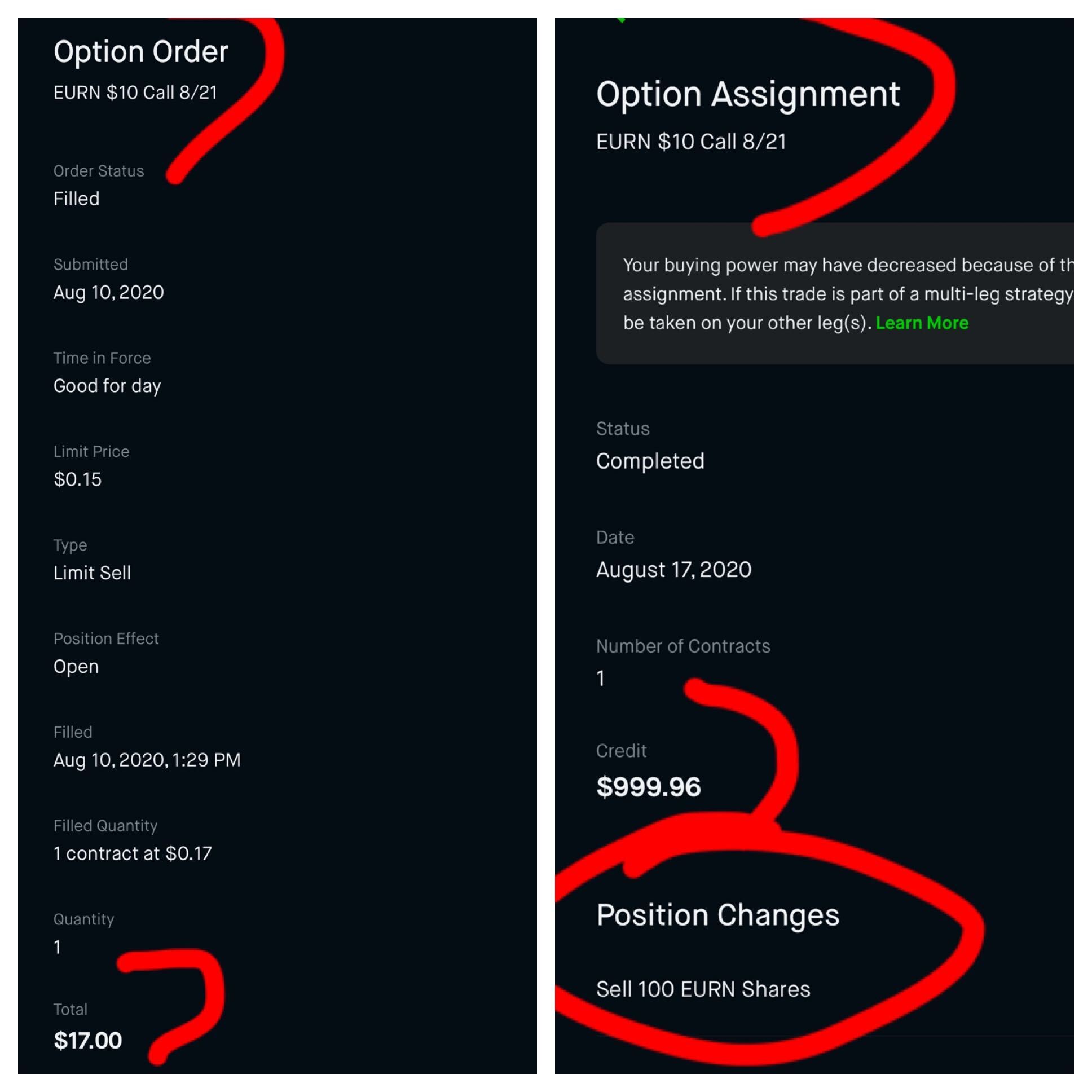

How to Sell Stock w/ Covered Calls

Whenever the time comes for you to finally exit a position, you can also get paid to sell your stock (in the same way you were paid to buy it)…

Selling covered calls closer to the current price is going to generate a higher premium for you — so you can get a nice cash payday for selling those shares…

For example, when I wanted to exit GOGO & EURN stocks — I simply wrote a longer-dated call option against my 100 shares with a strike price under the current price, and considered them sold…

I was in no hurry to get rid of these stocks, and wouldn’t have cared if I just collected my premiums & held them for another month. But if you’re in a hurry to get rid of a stock, you might just sell the shares on the open market rather than via options contracts…

That’s All There Is To It!

Writing naked puts & covered calls enabled me to start generating some extra income, and also gave me a much deeper understanding of investing in general…

Let this be your low-risk way to explore the options markets. Don’t be the sucker buying puts & calls and paying the premium in order to speculate…

Instead, use naked puts & covered calls to accumulate long-term positions & generate extra income off of them…

In my opinion — it’s the right way to buy & sell stocks 🙂